The next industrial revolution is being built not on steel and steam but on data and connectivity, with private cellular networks emerging as the critical infrastructure powering this transformation. As industries from manufacturing to public safety race to deploy dedicated, high-performance wireless solutions, an intense competition is unfolding among technology providers to claim dominance in this burgeoning market. Recent market analysis reveals a landscape defined by staggering financial growth, a rapid technological migration from LTE to 5G, and fundamentally different strategies among the industry’s most powerful players. The battle to wire the enterprise world is well underway, with both established telecommunications giants and agile newcomers vying for a definitive leadership position in this lucrative and strategically vital space.

A Gold Rush for Enterprise Connectivity

The financial outlook for the private cellular network sector points toward an unprecedented expansion, with projections indicating that global spending on private LTE and 5G infrastructure is set to grow at a compound annual rate of nearly 22% between 2025 and 2028. This aggressive investment is expected to propel the market’s value beyond $7.2 billion by the end of that period, signaling a profound shift in enterprise priorities. This is not a distant forecast but a present-day reality, evidenced by a dramatic acceleration in real-world deployments. Over the last twelve months, nearly 1,300 new private network projects have been documented, a significant increase from the 900 recorded in the preceding year. This surge in activity underscores a broader industry transformation, with some analysts predicting that private networks could command as much as one-quarter of all mobile network infrastructure spending by the end of the decade, cementing their role as a cornerstone of modern industrial operations.

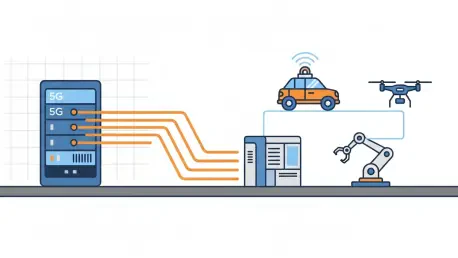

Driving this market explosion is a decisive technological pivot from legacy LTE to next-generation 5G, with 2025 serving as the transformative year in which 5G deployments are officially overtaking their predecessors across numerous vertical industries. The transition is particularly pronounced in industrial environments, where standalone private 5G networks are rapidly becoming the de facto standard for enabling Industry 4.0 applications like automation, robotics, and the Industrial Internet of Things (IIoT). This preference is reflected in capital allocation, as it is estimated that over 70% of total investments, equating to approximately $5.1 billion, will be directed specifically toward the buildout of these sophisticated standalone 5G networks. This massive capital infusion is solidifying their position as the predominant wireless connectivity medium for the manufacturing and process industries, promising unprecedented levels of speed, reliability, and low latency for mission-critical operations.

The Titans’ Diverging Paths

While traditional wireless infrastructure incumbents such as Ericsson, Nokia, and Huawei continue to command a significant share of the market, a fascinating strategic divergence is becoming apparent between the two leading Western vendors. Nokia, as it approaches the milestone of 1,000 private network deployments, is recalibrating its enterprise approach. The company is in the process of divesting its Enterprise Campus Edge (ECE) integration and software business to sharpen its focus on a channel partner-led model. This refined strategy will center on providing small cell radios alongside its own and third-party mobile core solutions, leveraging a well-established partner ecosystem that already accounts for 70% of its private network deals. This move suggests a strategic bet on specialization and collaboration over direct, all-encompassing control of the enterprise relationship, aiming for scale through a distributed and empowered network of partners.

In stark contrast to Nokia’s partnership-centric model, rival Ericsson is intensifying its commitment to the enterprise market by doubling down on a comprehensive, end-to-end portfolio. The Swedish behemoth is aggressively pushing a suite of solutions that includes compact and scalable private 5G systems, a small cell-based neutral host coverage platform, its robust line of Cradlepoint routers, and advanced AI-enabled management and orchestration tools. This direct, full-stack approach appears to be paying dividends, with the firm reporting several “two-digit million dollar deals” for complex, multi-site campus networks. Further highlighting its forward-looking focus, 83% of its new private network deployments are now based on 5G technology. This all-in strategy positions Ericsson not just as a component supplier but as a holistic solutions provider, aiming to own the entire enterprise wireless experience from the radio to the cloud.

An Expanding and Diverse Ecosystem

Despite the dominance of industry giants, the private network segment is distinguished by a far greater diversity of vendors compared to the highly consolidated public mobile network market. This sector has become a fertile ground for innovation, attracting a vast and growing number of Original Equipment Manufacturers (OEMs) and specialized vendors who are carving out significant market niches. Companies such as Celona, Globalstar, Airspan Networks, Mavenir, Druid Software, and HPE are making their presence known by providing specialized RAN, mobile core, and transport network equipment. This rich and varied landscape offers enterprise customers a wider array of choices, fostering competition and enabling the creation of highly customized networks tailored to specific operational needs. This diversity prevents the market from becoming a simple duopoly and ensures a continuous stream of new technologies and business models.

Further complicating the competitive landscape is the emergence of a disruptive new trend: mobile operators and system integrators are transitioning from being mere consumers of technology to becoming creators of their own proprietary infrastructure solutions. For instance, the Vietnamese national mobile operator Viettel has developed a complete private 5G product portfolio that includes both Radio Access Network (RAN) and core network functions. Similarly, the German system integrator COCUS now offers an in-house 4G/5G packet core software solution, sourcing only RAN and hardware components from its partners. Even consumer electronics giant LG Electronics has entered the market, leveraging Open RAN-compliant radio units to build its own offerings. This blurring of traditional roles signals a maturing market where customized, vertically integrated solutions are beginning to challenge the established dominance of off-the-shelf products from legacy vendors, creating new avenues for competition and innovation.

The New Blueprint for Industrial Connectivity

The fierce competition within the private 5G network space ultimately forged a new and dynamic market structure. The race was never about a single vendor achieving total dominance but was instead about defining the very blueprint for the future of industrial communication. The strategic divergences between major players like Nokia and Ericsson, coupled with the energetic rise of a diverse ecosystem of specialized vendors and in-house developers, established a landscape that was far more fragmented, innovative, and customer-centric than its public network counterpart. The winning formula was not a monolithic, one-size-fits-all approach. Instead, it was the collective impact of specialized solutions, agile partner-led models, and comprehensive end-to-end offerings that reshaped the enterprise connectivity paradigm, providing organizations with the tailored, high-performance tools they needed to power the next wave of industrial transformation.