On a day marked by a powerful endorsement from Wall Street, Lumentum Holdings Inc. found itself navigating a peculiar market paradox, where a compelling long-term growth story fueled by the artificial intelligence revolution collided head-on with short-term investor anxiety. The events of December 16, 2025, saw the optical components manufacturer receive a significant valuation upgrade from a major firm, reinforcing its critical position in the AI infrastructure buildout. Yet, this bullish signal was met not with a surge, but with a surprising 6% decline in its stock price, a stark demonstration of the market’s complex struggle to price a company caught between explosive future demand and the very real physical constraints of meeting it. This divergence created a fascinating case study, highlighting the sophisticated interplay between forward-looking theses, immediate supply chain pressures, and the inherent volatility of a stock that has undergone a rapid and substantial repricing in the new era of AI.

The Confluence of Bullish Catalysts

The primary driver of the day’s narrative was a significant recalibration by Wall Street, led by a widely circulated analyst note from Bank of America. The firm dramatically raised its price target on Lumentum to $375 from a previous $210, a move that captured the market’s attention. However, the true nuance lay in its decision to maintain a “Neutral” rating on the stock. This seemingly contradictory stance is highly significant; it suggests that even analysts who are not overtly bullish are being compelled by overwhelming market data to concede that the demand ceiling for Lumentum’s high-speed optical products is far higher than their previous models had anticipated. The firm’s rationale explicitly pointed to outsized demand for optical transceivers and related components, where customer orders continue to exceed the available supply. This analysis serves as a powerful validation of the broader market theme: the frantic physical construction of next-generation AI data centers is colliding with the real-world manufacturing limitations of the advanced technology supply chain, creating a highly favorable pricing and demand environment for essential suppliers like Lumentum.

Further bolstering the company’s long-term prospects, Lumentum announced a strategic addition to its leadership, appointing Thad Trent, the Chief Financial Officer of onsemi, to its Board of Directors. While board changes can often be minor news, this specific appointment was widely interpreted as a signal of enhanced operational focus and credibility. Trent’s extensive background in managing the financial and operational complexities of a large, global semiconductor company is seen as directly relevant to Lumentum’s most pressing challenge: scaling its manufacturing capacity to meet an unprecedented surge in demand while maintaining capital discipline and profitability. The narrative was further reinforced by a recent industry report from TrendForce, which provided stark data on an emerging supply bottleneck. The report projected that shipments of high-speed 800G and faster optical transceivers are set to soar from 24 million units in 2025 to nearly 63 million in 2026—a jump of 2.6 times in a single year. Crucially, TrendForce identified an upstream shortage of essential laser light sources, specifically citing electro-absorption modulated lasers (EMLs) as a key chokepoint due to their manufacturing complexity and the limited number of global suppliers, which includes Lumentum.

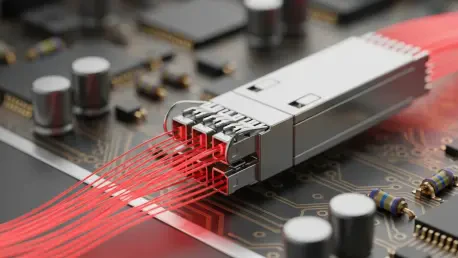

Photonics as the Indispensable Plumbing of AI

The investment thesis surrounding Lumentum has undergone a fundamental transformation, shifting away from its traditional perception as a cyclical supplier to the telecommunications industry toward a new identity as a foundational “picks-and-shovels” provider for the entire AI revolution. The prevailing analogy is that if GPUs from companies like Nvidia are the powerful engines of artificial intelligence, then the high-speed optical interconnects that Lumentum produces are the essential plumbing. As AI models and their supporting data centers continue to scale at an exponential rate, the primary performance constraint is rapidly shifting from raw computational power to the ability to move massive datasets between thousands of processors with minimal latency. This is the domain where Lumentum’s technology becomes indispensable. The physical and power limitations of traditional copper wiring are making it obsolete in high-performance environments, forcing a critical transition to optical technologies like silicon photonics and co-packaged optics. These technologies are necessary to enable the 400G, 800G, and future 1.6T connectivity speeds required by modern AI clusters. Lumentum’s extensive portfolio of lasers, modulators, photodiodes, and integrated photonic engines places it directly in the critical path of a multi-year capital expenditure cycle by the world’s largest cloud and technology companies.

This compelling narrative is not merely theoretical; it is firmly anchored by the company’s recent financial performance and its robust forward guidance. In its most recently reported quarter, fiscal Q1 2026, Lumentum posted net revenue of $533.8 million and non-GAAP earnings per share of $1.10, demonstrating solid execution. More importantly, its outlook for the subsequent quarter, fiscal Q2 2026, projected a significant acceleration in growth. The company guided revenues to a range between $630 million and $670 million and forecasted non-GAAP EPS to be between $1.30 and $1.50. This strong, quantifiable growth forecast provides the fundamental basis that analysts are using to justify their rapidly expanding price targets. It also reinforces management’s commentary about the powerful momentum building in its data center-related businesses, giving tangible evidence that the demand surge from the AI sector is translating directly into accelerated financial results and providing a solid foundation for the bullish investment case.

Reconciling the Market’s Mixed Signals

The rapid evolution of the Lumentum story has created a noticeable divergence in analytical viewpoints, a common occurrence when a stock’s price moves faster than consensus models can adapt. At the forefront are the most bullish analysts, with firms like Rosenblatt Securities joining Bank of America at the high end, having earlier raised their price target to $380 with a “Buy” rating. This clustering of optimistic targets in the $375-$380 range indicates where the most forward-looking analysis is pointing, explicitly tying the company’s valuation to its prime positioning within the AI infrastructure boom. This sentiment is echoed across various forms of market analysis. A Zacks commentary framed Lumentum as a top beneficiary of the photonics trend, highlighting aggressive revenue growth projections of 56% for the current year. Meanwhile, quantitative models, such as one from Validea, identified the stock for its powerful and persistent price momentum. Even valuation-focused notes from outlets like Simply Wall St, while acknowledging the stock’s premium price-to-sales ratio of around 12.9x, argued that such a multiple is justified by analyst expectations of over 50% revenue growth in the coming year. This contrasts sharply with the lagging Wall Street consensus, which, according to data from MarketBeat, still holds a “Moderate Buy” rating with an average price target far below these loftier new figures.

The day’s 6% pullback, happening in the face of such positive long-term news, can be attributed to several factors inherent to a stock in Lumentum’s unique position. Having experienced a dramatic run-up in recent months, the stock is naturally susceptible to increased volatility. Such pullbacks are common and can be driven by mechanical factors like profit-taking by early investors, complex options-related trading strategies, and routine portfolio rebalancing by large institutional funds, all of which can occur independently of the underlying long-term thesis. Furthermore, as its valuation multiples have expanded, Lumentum has begun to trade less like a traditional components supplier and more like a high-beta member of the broader “AI complex.” This makes it more sensitive to macroeconomic shifts and susceptible to declines on days of general risk aversion. Finally, the narrative of supply constraints is a double-edged sword. While the idea that “demand exceeds supply” is bullish for pricing power, the market can quickly pivot to worrying that these same supply limitations will cap near-term revenue upside. The TrendForce report on the EML bottleneck likely fueled concerns about whether Lumentum can physically produce enough components to meet its own rosy growth targets, creating a source of near-term uncertainty.

A Forward Look at Execution and Expectations

The events of the day crystallized the central tension for investors, where the long-term potential of Lumentum became intricately tied to its immediate operational capabilities. The market’s reaction signaled a shift in focus; the debate was no longer about whether optical networking was critical to the future of AI, a point that had been largely settled, but whether Lumentum could successfully navigate the immense pressures of a historic demand wave. The key risk, now at the forefront of investor minds, was execution. The ability to scale the production of highly complex components like EMLs without sacrificing quality, yield, or margins was identified as the paramount challenge. This operational hurdle, combined with the risk of customer concentration within a few hyperscale cloud providers and the ever-present danger of multiple compression—where any slight disappointment in growth could cause its premium valuation to contract sharply—defined the landscape of risks. The market’s sharp pullback in response to a bullish forecast underscored that the high-premium multiple awarded to the stock demanded near-flawless execution, leaving little room for error in the quarters ahead.