The American broadband market has become a battleground where legacy cable giants are fighting a multi-front war against nimble and technologically advanced adversaries. Amidst a challenging market defined by relentless pressure from telecommunications companies expanding their fiber networks, mobile providers aggressively pushing fixed wireless access, and the ever-growing reach of satellite internet, Charter Communications finds itself at the center of a brewing controversy. While industry analysis suggests that most cable companies are in a defensive crouch, forced to lower prices and accept reduced revenue to retain customers, a formal complaint filed with the Federal Communications Commission (FCC) paints a different picture of Charter. Allegations suggest the company may be moving from a defensive strategy to an overtly offensive one, aimed not just at competing but at systematically dismantling the operational capacity of its smaller rivals, particularly in the fixed wireless sector. This has raised serious questions about fair play and the future of competition in underserved areas.

An Alleged Anti-Competitive Strategy

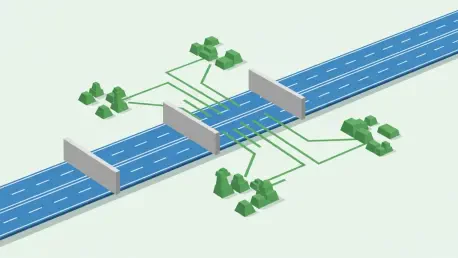

The controversy stems from a formal complaint by the Wireless Internet Service Provider’s Association (WISPA), which has sounded the alarm over an alleged internal policy at Charter. The policy reportedly directs the company to cease entering into or renewing contracts for essential upstream wholesale backhaul services with Wireless Internet Service Providers (WISPs). These backhaul services are the logistical backbone for WISPs, providing the critical connection from their local wireless networks to the wider internet infrastructure, which is often owned and operated by established cable and fiber companies like Charter. Without reliable backhaul, a WISP is effectively an island, unable to deliver the internet connectivity its customers depend on. WISPA’s complaint contends that this is not a coincidental shift in business practice but a targeted strategy designed to cripple competitors who rely on Charter’s infrastructure to operate, effectively cutting them off at the knees in a market where they are already fighting for survival.

The potential fallout from this alleged policy, as outlined by WISPA, could be particularly devastating for smaller, regional WISPs that serve rural and less-populated communities. In many of these areas, Charter may be the only viable provider of the high-capacity fiber lines needed for wholesale backhaul, leaving these smaller providers with no alternative. The association warns that this could create a domino effect, leading to the collapse of local internet providers and leaving their customers with fewer, and potentially more expensive, choices for internet service, or in some cases, no choice at all. This raises significant public interest concerns, prompting WISPA to urge the FCC to closely monitor the situation. The apprehension is further amplified by the potential for such a policy to become an industry standard, especially in the context of proposed mergers like the one between Charter and Cox Communications, which could consolidate infrastructure control even further and reduce competitive leverage for smaller players across the country. Charter has so far declined to comment on the allegations.

Navigating a Defensive Market

This aggressive stance, if proven true, stands in stark contrast to the broader trends observed across the cable industry. According to recent analysis from Wolfe Research, the sector has been largely characterized by a defensive posture in the face of fierce competition. The relentless expansion of fiber-to-the-home networks by telcos and the surprisingly successful rollout of 5G-based fixed wireless access (FWA) by mobile carriers have put traditional cable operators on the back foot. To prevent customer churn, these companies have been forced into a difficult position, often having to sacrifice pricing power and lower their average revenue per user (ARPU) to remain competitive. This strategy of retention through price reduction, while necessary, erodes profitability and signals a fundamental shift in market dynamics where cable is no longer the undisputed king of high-speed internet. The industry is grappling with a new reality where its primary competitive advantages are being challenged on multiple fronts simultaneously.

The accusations against Charter suggest a potential pivot from this defensive, price-focused competition to a more direct and exclusionary form of engagement. Instead of simply trying to offer a better value proposition to consumers, the alleged policy targets the operational viability of competitors themselves. By potentially denying access to essential infrastructure, a company can stifle competition without ever having to engage in a price war. This approach, if it is indeed Charter’s strategy, could reshape the competitive landscape by creating “infrastructure deserts” for smaller providers, particularly in markets where competitive options for backhaul are already scarce. It transforms the nature of the fight from a consumer-facing battle over price and speed to a behind-the-scenes struggle for the very right to operate, raising fundamental questions for regulators about how to ensure a level playing field when dominant players control the underlying infrastructure that their rivals need to exist.

The Regulatory Crossroads

The complaint filed by WISPA placed a significant decision before the Federal Communications Commission. The agency was tasked with determining whether Charter’s alleged refusal to provide backhaul services represented a legitimate business decision in a fiercely competitive market or a calculated, anti-competitive maneuver designed to unlawfully leverage its market power. This investigation delved into the core principles of fair access and the responsibilities of incumbent infrastructure owners. The outcome of this case ultimately influenced the regulatory framework governing wholesale access to critical broadband infrastructure, setting a precedent for how similar disputes would be handled in an era of increasing market consolidation. The decision had far-reaching implications, not only for the immediate parties involved but for the broader health of competition and the future of internet access in rural and underserved communities across the nation.