In a move signaling significant ambition and confidence, Meig Intelligent Technologies has officially renewed its application for a listing on the Main Board of the Hong Kong Stock Exchange, marking its second attempt within a year to tap into the public markets. With the backing of exclusive sponsor China International Capital Corporation, the wireless communication module giant is putting its impressive market standing and technological prowess on full display for potential investors. The company, which already secured the position of the world’s fourth-largest wireless communication module provider by revenue in 2024 with a 6.4% global market share, is betting that its leadership in the booming sectors of 5G connectivity and edge Artificial Intelligence will be the decisive factor in achieving a successful initial public offering. This IPO prospectus offers more than just financial figures; it presents a detailed narrative of a company strategically positioned at the convergence of several transformative technology trends, including the Internet of Things, smart vehicles, and the decentralization of AI computing. The core question for the market is whether this compelling strategic vision can translate into sustained long-term value and justify a premium valuation in a complex global economic environment.

A Two-Pronged Strategy for Market Leadership

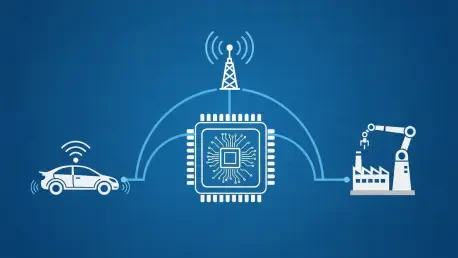

Meig Intelligent has meticulously crafted a business model that positions it as a premier provider of not just wireless communication modules, but highly integrated solutions that form the backbone of modern smart devices. The company’s strategy is sharply focused on the development and widespread deployment of intelligent modules, particularly high-performance variants that are essential for the next wave of technological innovation. Its stated mission is to serve as a key enabler for the proliferation of device-level intelligence, edge AI, and advanced 5G communications across a multitude of industries. This strategic emphasis allows Meig to move beyond being a simple component supplier and become a critical partner for companies looking to build sophisticated, AI-powered products. By concentrating on the upper echelon of the market with high-performance modules, the company differentiates itself from competitors that may focus on high-volume, lower-margin standard modules, thereby cultivating a reputation for cutting-edge technology and robust performance.

This strategic focus is executed across three primary application domains that represent some of the highest-growth areas in technology today: the expansive Internet of Things (IoT), the rapidly evolving smart connected vehicle sector, and the crucial field of wireless broadband. Within these domains, Meig’s product portfolio is centered on intelligent modules that offer both standard and high-performance computing capabilities, alongside traditional data transmission modules. To maintain its competitive edge and operational efficiency, Meig operates on a fabless business model, a common practice within China’s semiconductor and communications industry. This approach allows the company to retain direct control over the most valuable stages of the product lifecycle—research, development, and design—while strategically outsourcing the capital-intensive and logistically complex manufacturing processes to specialized third-party Electronics Manufacturing Services (EMS) suppliers. This lean operational structure enables Meig to remain agile, innovate rapidly, and focus its resources on pushing the boundaries of wireless and AI technology.

Pioneering Edge AI and Dominating the 5G Automotive Space

Meig Intelligent’s claim to market leadership is firmly rooted in a proven history of technological firsts and a dominant position in key high-growth segments. The company was a true trailblazer in its field, having introduced the world’s first intelligent module product as far back as 2014. This early entry gave it a significant head start in understanding and capitalizing on the seismic shift of AI computing from centralized cloud servers to decentralized edge devices. This foresight has paid off handsomely, as Meig has now established itself as the world’s largest supplier of high-performance intelligent modules. According to market analysis from Frost & Sullivan, the company commanded an impressive 29.0% global market share in this critical segment by revenue in 2024. These modules are not just components; they are the foundational hardware enabling a vast array of sophisticated edge AI applications. The company’s innovation milestones are a testament to its technical capabilities, including the development of the world’s first high-performance intelligent module with a computing capacity of 48 TOPS and becoming the first company globally to successfully run a generative AI text-to-image model directly on a module in 2023.

In parallel with its advances in AI, Meig is a formidable leader in the global transition from 4G to 5G connectivity. It was among the first companies worldwide to launch 5G data transmission modules and has continued to innovate with the early introduction of next-generation 5G-Advanced (5G-A) and 5G RedCap module products, ensuring its technology remains at the forefront of telecommunications. This deep expertise in 5G is most visibly demonstrated in the automotive sector, a key battleground for connectivity solutions. In 2024, based on shipment volumes, Meig ranked first globally in the 5G vehicle-mounted module industry, capturing a remarkable 35.1% of the global market. A landmark achievement came in 2021 when the company’s 5G intelligent modules were deployed in a leading Chinese manufacturer’s new energy vehicles, marking the first global instance of large-scale deployment of this technology in the electric vehicle sector. This success has cemented Meig’s status as a critical and trusted supplier for the future of mobility, where reliable, high-speed connectivity is paramount for everything from in-vehicle infotainment to advanced driver-assistance systems.

A Closer Look at the Financial Landscape

The company’s prospectus provides a detailed financial overview that paints a picture of substantial revenue growth, underscoring the strong market demand for its advanced modules and solutions. Meig Intelligent reported revenues of RMB 2.306 billion for the fiscal year 2022, which saw a minor contraction to RMB 2.147 billion in 2023 before experiencing a significant rebound. For the fiscal year 2024, revenues surged to RMB 2.941 billion, demonstrating a robust recovery and expansion. This positive momentum continued into the current fiscal year, with the company reporting RMB 1.887 billion in revenue for the six-month period ending June 30, 2025. This consistent top-line growth serves as a powerful indicator of the company’s ability to capture market share and capitalize on the increasing integration of wireless communication and AI technologies across its key target industries. The revenue trajectory suggests that Meig’s strategic focus on high-value, high-performance products is resonating with a global customer base that is increasingly reliant on sophisticated connectivity.

However, a deeper dive into the company’s profitability reveals a more complex narrative that potential investors will need to carefully consider. The company’s gross profit followed its revenue trend, standing at RMB 405 million in 2022 and rising to RMB 485 million in 2024. Yet, the corresponding gross profit margins have shown a concerning downward trend recently. After holding steady at 17.6% in 2022 and 18.4% in 2023, the margin compressed to 16.5% in 2024 and fell more sharply to 12.9% for the first six months of 2025. This pressure on margins could indicate increased competition, rising input costs, or a shift in product mix toward lower-margin offerings. The company’s net profit has also been volatile, dropping from RMB 127 million in 2022 to just RMB 62.609 million in 2023, before recovering in the first half of 2024. While the latest six-month profit of RMB 84.167 million is solid, the variability in both margins and net profit highlights potential risks that will likely be a key focus of investor scrutiny during the IPO process.

Riding a Bullish Market with Strong Backing

The industry analysis included in the prospectus provided a significant tailwind for Meig’s IPO ambitions, painting a decidedly bullish picture for the future of the wireless communication module market. According to the Frost & Sullivan report, the global market is projected to accelerate its growth, expanding from RMB 43.6 billion in 2024 to an estimated RMB 72.6 billion by 2029. Crucially, the specific segments where Meig has established its dominance are forecasted to grow at an even more rapid pace. The market for high-computing-power intelligent modules, where Meig is the global leader, is expected to surge at a compound annual growth rate of 23.9% through 2029. Similarly, the connected vehicles segment, another area of Meig’s market leadership, is projected to expand at an even faster CAGR of 24.0%. This alignment between Meig’s core competencies and the industry’s fastest-growing sectors provides a compelling argument that the company is well-positioned to capture a disproportionate share of future market growth, reinforcing the central thesis of its investment case.

The company’s pursuit of a public listing was guided by a well-defined corporate governance structure and supported by a team of leading professional firms, which provided the institutional credibility necessary for such a significant corporate action. Upon its listing in Hong Kong, the board was set to comprise seven members, including a mix of executive and independent directors, ensuring a balance of oversight. The equity structure was clearly outlined, with Mr. Wang Ping identified as the controlling shareholder, holding a total interest of 49.16%. The IPO process itself was backed by a roster of top-tier intermediaries. China International Capital Corporation served as the sole sponsor, while legal counsel was provided by esteemed firms like Paul Hastings and Han Kun Law Offices. With Ernst & Young as the auditor and Frost & Sullivan providing the critical industry analysis, Meig assembled a formidable team to navigate the complexities of the IPO. This strong backing, combined with its strategic positioning in high-growth markets, created a narrative that was clearly designed to resonate with investors looking for exposure to the future of 5G and AI.