The decision of how to invest billions in network infrastructure has become the defining challenge for cable operators, pitting the allure of a pristine, all-fiber future against the pragmatic and powerful potential still locked within millions of miles of existing coaxial cable. This strategic crossroads is where the future of home internet will be decided, shaped not just by raw speed, but by economic reality, fierce competition from wireless upstarts, and a surprisingly robust technology roadmap that promises to keep coax relevant for years to come.

The Crossroads of Connectivity Why Cable’s Enduring Faith in Coax Still Matters

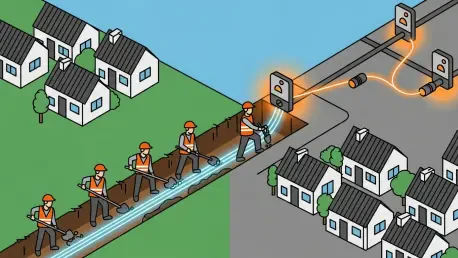

The broadband battlefield is a complex arena where legacy infrastructure must contend with the ever-increasing demands of next-generation applications. For cable operators, this means their vast Hybrid Fiber/Coax (HFC) networks, once the undisputed champions of high-speed internet, are now facing intense pressure from both fiber-to-the-premises (FTTP) deployments and the rapidly expanding reach of Fixed Wireless Access (FWA). The stakes have never been higher, as companies must decide where to allocate their capital to maintain a competitive edge.

At the heart of this dilemma is a fundamental economic calculation. A full-scale conversion to fiber is an astronomically expensive and time-consuming undertaking, particularly in established “brownfield” service areas. In contrast, upgrading the existing HFC plant with the latest DOCSIS technology represents a fraction of that cost. This financial reality forces a critical question: is the incremental benefit of “pure fiber” worth the monumental investment when upgraded coax can already deliver multi-gigabit speeds that satisfy the vast majority of consumer needs?

This high-stakes decision is further complicated by a shifting competitive landscape. The rise of FWA from mobile carriers has changed the nature of the fight, moving it beyond a simple “speeds and feeds” comparison. Economic realities and the surprising resilience of the DOCSIS technology roadmap are now shaping how cable operators plan to defend their market share and define the future of home internet.

Decoding the DOCSIS Gambit A Strategic Deep Dive

The Billion-Dollar Calculation Prioritizing Pragmatic Performance Over Fiber Purity

The core argument for upgrading HFC infrastructure is rooted in capital efficiency. For established service areas, operators can deliver competitive multi-gigabit downstream speeds through DOCSIS enhancements for a fraction of the cost of a complete fiber buildout. This pragmatic approach allows them to respond to market demands for more speed without the disruptive and costly process of replacing the final coaxial connection to the home, preserving capital for other strategic initiatives.

This focus on pragmatism is amplified by the market disruption caused by FWA. Low-cost wireless alternatives have shifted the competitive calculus away from a pure obsession with raw speed. Cable operators now find that bundling services and ensuring customer loyalty are more critical than ever. The battle is increasingly being fought over value and retention rather than simply having the fastest advertised speeds.

In this environment, strategies like multi-year price locks and integrated mobile offerings have emerged as cable’s primary defense against customer churn. These tactics create a stickier customer relationship that is less susceptible to the promotional pricing of competitors. This bundled-service approach proves more effective at maintaining a stable subscriber base than engaging in a perpetual, margin-eroding price war.

One Technology Many Playbooks How Industry Giants Are Forging Unique Upgrade Paths

The path forward with DOCSIS is not monolithic; major operators are adopting diverse strategies tailored to their specific market conditions and financial goals. Comcast, for instance, is pursuing an aggressive deployment of Full Duplex (FDX) DOCSIS 4.0, aiming to deliver symmetrical multi-gigabit speeds across its footprint. In contrast, Charter Communications is taking a more measured, hybrid approach, enhancing its existing DOCSIS 3.1 plant while selectively upgrading network segments to full DOCSIS 4.0 where competitive pressure warrants it.

This spectrum of choice is further illustrated by other players in the industry. Mediacom Communications has committed fully to a DOCSIS 4.0 upgrade, signaling a firm belief in the long-term viability of HFC. Meanwhile, Midco is leveraging a “DOCSIS 3.1+” enhancement to deliver multi-gigabit downstream performance without the capital expenditure of a complete 4.0 overhaul. Altice USA showcases a split strategy, deploying fiber in its dense northeastern markets while upgrading its more rural western HFC networks with mid-split enhancements for improved upstream performance.

Each of these distinct paths carries its own set of risks and opportunities. Aggressive DOCSIS 4.0 deployments require significant capital but promise a faster time-to-market for higher upstream speeds, a key competitive differentiator. More conservative, incremental upgrades conserve capital but may leave operators vulnerable in markets with intense fiber competition. This strategic diversity underscores the flexibility of the DOCSIS roadmap.

Beyond 10G Charting the Roadmap to 50 Gigabit Coax

The evolution of HFC technology does not end with the current 10G standard. CableLabs is already charting the next frontier with a “DOCSIS 4.0 optional annex” designed to expand the usable spectrum on coaxial networks to 3GHz. This expansion would enable incredible speeds of up to 25 Gbit/s, fundamentally challenging the notion that coax is nearing its technological ceiling.

Beyond this, there is considerable industry ambition to push HFC capabilities even further, potentially extending the network spectrum to 6GHz. Such a leap would unlock a theoretical potential of 50 Gbit/s, a capacity that would keep coax competitive with fiber for the foreseeable future. This forward-looking roadmap demonstrates a deep commitment to maximizing the value and longevity of existing HFC assets.

However, achieving these future milestones presents significant technical and financial hurdles. Pushing to higher frequencies will necessitate new power requirements for network components and may require costly amplifier respacing. Operators must carefully weigh these future upgrade costs against the alternative of a full transition to a passive optical network (PON), making for a complex, long-term strategic decision.

More Than Just Speed The Hidden Value and Hurdles of a Powered HFC Network

An often-overlooked advantage of HFC is its inherently powered network, a feature that passive optical networks lack. This existing power grid can be leveraged to support a variety of ancillary mobile and wireless services, turning the broadband network into a multi-purpose infrastructure asset. This capability adds a layer of strategic value beyond simple internet delivery.

Charter’s innovative “fiber-powered DAS” (Distributed Antenna System) concept serves as a prime example of this potential. By leveraging its powered network, the company can efficiently deploy small cells and other wireless infrastructure, enhancing mobile coverage and creating new revenue opportunities. This demonstrates how HFC can be a foundational element for a broader connectivity ecosystem.

These advantages must be balanced against the persistent operational challenges of HFC. Maintaining an active plant with numerous amplifiers and power supplies incurs long-term costs that a passive optical network avoids. The strategic calculus for operators involves weighing the ancillary benefits and lower upfront upgrade costs of HFC against the higher operational expenditures over the life of the network.

Executing the Upgrade Key Takeaways and Strategic Imperatives for Operators

The central insight for cable operators is that a tailored DOCSIS upgrade remains the most capital-efficient strategy for competing effectively in established service areas. While fiber is the undisputed choice for new “greenfield” builds, enhancing the existing HFC plant provides a powerful and financially sound path to delivering the multi-gigabit speeds customers demand.

Success in this competitive landscape requires a balanced approach. Network investment must be paired with aggressive customer retention tactics that build loyalty and reduce churn. Combining faster speeds from DOCSIS upgrades with the value of mobile bundling and the stability of predictable pricing creates a compelling proposition that is difficult for competitors to dismantle.

Ultimately, operators can leverage the inherent flexibility of the DOCSIS roadmap to their advantage. This allows them to match network spending with specific, market-by-market competitive threats. Instead of a one-size-fits-all overhaul, they can surgically deploy capital where it is needed most, ensuring a maximum return on investment while staying ahead of the competition.

The Long Horizon for Coax Why DOCSIS Remains a Competitive Powerhouse for the Foreseeable Future

The strategic decisions made by cable operators affirmed that while fiber represented the ultimate destination for network architecture, the journey would be powered by DOCSIS for many years. The economic and logistical realities of overhauling national infrastructure made an incremental, upgrade-focused approach the only viable path forward for established networks.

This continued evolution of HFC stood as a testament to remarkable engineering ingenuity. The ability to extract ever-increasing capacity from coaxial cable ensured that operators remained formidable players in the broadband landscape, capable of meeting and often exceeding customer expectations without undertaking financially prohibitive rebuilds.

The final analysis showed that this adaptable strategy allowed cable operators to innovate and compete from a position of strength. By carefully managing the immense financial realities of network evolution, they successfully navigated a complex market, proving that the long-term investment in their existing infrastructure was a bet that had paid off handsomely.