As Wisconsin grapples with the financial aftermath of its reliance on coal, ratepayers find themselves burdened with a staggering $1 billion debt for power plants that have long since gone silent, a cautionary tale echoing through the state’s energy sector. This legacy of “stranded assets”—investments that became obsolete before their costs were recovered—casts a long shadow over a new, power-hungry industry promising economic revitalization: artificial intelligence and its massive data centers. With utilities proposing a new generation of power plants to meet this demand, a critical question emerges: is Wisconsin on the verge of repeating its past errors on an even grander scale, potentially locking its citizens into another billion-dollar financial quagmire for decades to come? The debate pits the promise of technological advancement against the hard-learned lessons of premature obsolescence and fiscal responsibility.

A History of Overcommitment to Coal

The concept of stranded assets in Wisconsin is not a recent phenomenon but the result of decades of strategic decisions that prioritized coal power long after its economic viability began to wane. The state’s regulatory framework, established in 1907 to manage regional utility monopolies, empowered the Public Service Commission (PSC) to approve new power plants and rate hikes. However, while other regions began diversifying their energy portfolios, Wisconsin’s utilities, with PSC approval, continued to double down on coal. This over-investment became increasingly problematic as market forces shifted. By 2016, natural gas had surpassed coal as the leading source of electricity generation nationwide due to its lower cost, and overall energy consumption in the state had plateaued, leaving expensive coal plants like Pleasant Prairie to sit idle for much of the year before its eventual closure. This pattern of miscalculation left a trail of costly financial obligations for consumers.

The financial consequences of these decisions are starkly illustrated by several key projects. In 2011, We Energies funneled nearly $1 billion into its Oak Creek coal-fired plant to extend its operational life by 30 years, an investment made to comply with federal and state environmental regulations. Today, that plant is scheduled for complete retirement in 2026, leaving an outstanding debt of $650 million on its books that individual ratepayers will be paying off for the next 17 years at a cost of nearly $30 annually. Similarly, in 2013, Alliant Energy invested over $800 million in the Columbia Energy Center to settle pollution violations, only to announce plans for its closure less than a decade later, although its operation is now expected to continue until at least 2029. These examples highlight a persistent strategy of costly retrofits and upgrades to aging infrastructure, a choice that ultimately saddled ratepayers with the long-term costs of assets that could no longer compete in a changing energy landscape.

Incentives That Fueled Overbuilding

The cycle of constructing and upgrading power plants was propelled by a convergence of political and financial incentives that often prioritized short-term gains over long-term economic prudence. The construction of a new plant typically creates over a thousand jobs, a prospect that holds significant appeal for politicians seeking to demonstrate economic development. Furthermore, the regulatory environment itself, governed by precedent within the quasi-judicial Public Service Commission, created a self-perpetuating logic. An initial decision to approve a utility plant could be used as a strong argument in favor of approving subsequent expansions or upgrades, regardless of shifting market conditions. This system, as noted by the Wisconsin Citizens Utility Board, allowed utilities “to overbuild the system” by continually doubling down on investments, particularly in coal, even as it became increasingly uneconomic.

At the heart of this issue is the fundamental business model of regulated utilities, which are incentivized to invest in physical infrastructure. Utilities earn a guaranteed rate of return, typically around 9.8%, on the capital they invest in building or acquiring assets. This structure creates a powerful motivation to “put steel in the ground,” as there is a direct financial benefit to building more, and potentially to overbuilding. When the PSC approves a new power plant, it simultaneously allows the utility to set electricity rates high enough to recover its investment plus this guaranteed profit. Critically, this arrangement persists even after a plant is shut down and becomes a stranded asset. For example, when the Pleasant Prairie plant closed in 2018 with nearly $1 billion in remaining value, the PSC ruled that ratepayers would continue to pay not only the outstanding cost of the plant but also the utility’s nearly 10% profit margin on that debt, a financial obligation expected to extend into the early 2040s.

A New Stranded Asset Threat on the Horizon

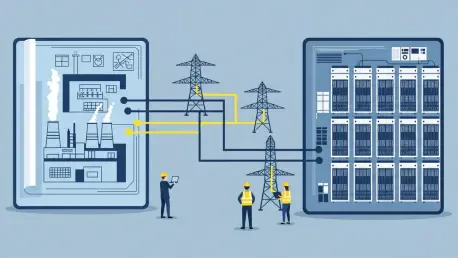

The rapid expansion of artificial intelligence is creating an unprecedented demand for electricity, driving a wave of data center construction across Wisconsin and raising the specter of a new generation of stranded assets. These facilities, which house the vast computing power needed for AI programs, are incredibly energy-intensive. We Energies alone is planning to add enough new energy capacity to power over two million homes, largely to serve a single Microsoft data center in Mount Pleasant—dubbed “the world’s most powerful data center”—and another facility in Port Washington for OpenAI and Oracle. With additional data centers proposed in communities from Beaver Dam to Menomonie, utilities are preparing to request PSC approval for new power plants to meet this demand.

This boom, however, carries immense financial risk for the public. The central fear among consumer advocates is that the state will invest heavily in new power plants and transmission lines to serve these data centers, only for the technology or business models to shift, leaving the facilities scaled down or abandoned. If that happens, the cost of the now-unneeded energy infrastructure would fall squarely on the shoulders of residential and business ratepayers. Public skepticism is already growing; an October Marquette Law School poll revealed that 55% of respondents believe the costs of data centers outweigh their benefits. Opposition has mobilized across the state, from referendums in Janesville to protests in Port Washington, as citizens demand that data centers bear their own infrastructure costs. Unlike neighboring states such as Minnesota, which have enacted laws to protect ratepayers from such scenarios, Wisconsin currently has no specific legal safeguards in place to prevent the costs of a potential data center bust from being socialized.

Financial Tools and Planning Failures

As ratepayers face the burden of existing stranded assets, financial mechanisms that could alleviate these costs remain underutilized in Wisconsin, while comprehensive planning to prevent future mistakes is nonexistent. One such tool is securitization, a process similar to refinancing a mortgage. It allows a utility to convert the debt of a stranded asset into a specialized bond with a lower interest rate than the utility’s standard profit margin, directly saving customers money. However, Wisconsin law is restrictive, permitting utilities to securitize only the cost of pollution control equipment, not the entire value of a retired plant. Even this limited option is voluntary, and utilities have often declined to use it. For instance, while We Energies used securitization for its Pleasant Prairie plant, saving customers an estimated $40 million, it refused to do so for the Oak Creek plant, forgoing potential savings of $117.5 million. Legislative efforts to expand securitization and make it mandatory have failed, blocked by industry opposition.

Compounding the problem is Wisconsin’s lack of a structured, forward-looking energy planning process. The state is one of the few that does not require utilities to develop an integrated resource plan (IRP), a comprehensive framework for forecasting future energy needs and evaluating the most cost-effective ways to meet them. Without IRPs, the PSC evaluates each proposed power plant in isolation, a piecemeal approach that encourages overbuilding and fails to consider the cumulative impact on the state’s energy system and ratepayers. States like Minnesota and Michigan mandate IRPs to ensure a more orderly and economically sound energy transition. Proposals by Governor Tony Evers to implement IRPs in Wisconsin have been consistently removed from the state budget by Republican lawmakers. This absence of a cohesive statewide energy strategy leaves Wisconsin vulnerable to repeating the same costly errors of the past, approving massive new projects without a clear understanding of their long-term necessity or financial consequences.

A Legacy Etched in Debt

The decisions made regarding Wisconsin’s energy infrastructure have cemented a financial reality that will burden its citizens for generations. The legacy of over-investment in coal, driven by a regulatory framework that incentivized building over efficiency, left a billion-dollar debt that was not easily shed. Despite the availability of financial tools like securitization that could have lessened the impact on ratepayers, their limited and optional application meant that significant opportunities for savings were lost. The failure to adopt comprehensive planning mechanisms like integrated resource plans ensured that the state continued to approve major energy projects in a reactive, fragmented manner. As the state stands on the cusp of a new energy-intensive industrial boom, the policies and precedents of the past have already set a course that risks history repeating itself, leaving the question of who will ultimately bear the cost hanging in the balance.Fixed version:

As Wisconsin grapples with the financial aftermath of its reliance on coal, ratepayers find themselves burdened with a staggering $1 billion debt for power plants that have long since gone silent, a cautionary tale echoing through the state’s energy sector. This legacy of “stranded assets”—investments that became obsolete before their costs were recovered—casts a long shadow over a new, power-hungry industry promising economic revitalization: artificial intelligence and its massive data centers. With utilities proposing a new generation of power plants to meet this demand, a critical question emerges: is Wisconsin on the verge of repeating its past errors on an even grander scale, potentially locking its citizens into another billion-dollar financial quagmire for decades to come? The debate pits the promise of technological advancement against the hard-learned lessons of premature obsolescence and fiscal responsibility.

A History of Overcommitment to Coal

The concept of stranded assets in Wisconsin is not a recent phenomenon but the result of decades of strategic decisions that prioritized coal power long after its economic viability began to wane. The state’s regulatory framework, established in 1907 to manage regional utility monopolies, empowered the Public Service Commission (PSC) to approve new power plants and rate hikes. However, while other regions began diversifying their energy portfolios, Wisconsin’s utilities, with PSC approval, continued to double down on coal. This over-investment became increasingly problematic as market forces shifted. By 2016, natural gas had surpassed coal as the leading source of electricity generation nationwide due to its lower cost, and overall energy consumption in the state had plateaued, leaving expensive coal plants like Pleasant Prairie to sit idle for much of the year before its eventual closure. This pattern of miscalculation left a trail of costly financial obligations for consumers.

The financial consequences of these decisions are starkly illustrated by several key projects. In 2011, We Energies funneled nearly $1 billion into its Oak Creek coal-fired plant to extend its operational life by 30 years, an investment made to comply with federal and state environmental regulations. Today, that plant is scheduled for complete retirement in 2026, leaving an outstanding debt of $650 million on its books that individual ratepayers will be paying off for the next 17 years at a cost of nearly $30 annually. Similarly, in 2013, Alliant Energy invested over $800 million in the Columbia Energy Center to settle pollution violations, only to announce plans for its closure less than a decade later, although its operation is now expected to continue until at least 2029. These examples highlight a persistent strategy of costly retrofits and upgrades to aging infrastructure, a choice that ultimately saddled ratepayers with the long-term costs of assets that could no longer compete in a changing energy landscape.

Incentives That Fueled Overbuilding

The cycle of constructing and upgrading power plants was propelled by a convergence of political and financial incentives that often prioritized short-term gains over long-term economic prudence. The construction of a new plant typically creates over a thousand jobs, a prospect that holds significant appeal for politicians seeking to demonstrate economic development. Furthermore, the regulatory environment itself, governed by precedent within the quasi-judicial Public Service Commission, created a self-perpetuating logic. An initial decision to approve a utility plant could be used as a strong argument in favor of approving subsequent expansions or upgrades, regardless of shifting market conditions. This system, as noted by the Wisconsin Citizens Utility Board, allowed utilities “to overbuild the system” by continually doubling down on investments, particularly in coal, even as it became increasingly uneconomic.

At the heart of this issue is the fundamental business model of regulated utilities, which are incentivized to invest in physical infrastructure. Utilities earn a guaranteed rate of return, typically around 9.8%, on the capital they invest in building or acquiring assets. This structure creates a powerful motivation to “put steel in the ground,” as there is a direct financial benefit to building more, and potentially to overbuilding. When the PSC approves a new power plant, it simultaneously allows the utility to set electricity rates high enough to recover its investment plus this guaranteed profit. Critically, this arrangement persists even after a plant is shut down and becomes a stranded asset. For example, when the Pleasant Prairie plant closed in 2018 with nearly $1 billion in remaining value, the PSC ruled that ratepayers would continue to pay not only the outstanding cost of the plant but also the utility’s nearly 10% profit margin on that debt, a financial obligation expected to extend into the early 2040s.

A New Stranded Asset Threat on the Horizon

The rapid expansion of artificial intelligence is creating an unprecedented demand for electricity, driving a wave of data center construction across Wisconsin and raising the specter of a new generation of stranded assets. These facilities, which house the vast computing power needed for AI programs, are incredibly energy-intensive. We Energies alone is planning to add enough new energy capacity to power over two million homes, largely to serve a single Microsoft data center in Mount Pleasant—dubbed “the world’s most powerful data center”—and another facility in Port Washington for OpenAI and Oracle. With additional data centers proposed in communities from Beaver Dam to Menomonie, utilities are preparing to request PSC approval for new power plants to meet this demand.

This boom, however, carries immense financial risk for the public. The central fear among consumer advocates is that the state will invest heavily in new power plants and transmission lines to serve these data centers, only for the technology or business models to shift, leaving the facilities scaled down or abandoned. If that happens, the cost of the now-unneeded energy infrastructure would fall squarely on the shoulders of residential and business ratepayers. Public skepticism is already growing; an October Marquette Law School poll revealed that 55% of respondents believe the costs of data centers outweigh their benefits. Opposition has mobilized across the state, from referendums in Janesville to protests in Port Washington, as citizens demand that data centers bear their own infrastructure costs. Unlike neighboring states such as Minnesota, which have enacted laws to protect ratepayers from such scenarios, Wisconsin currently has no specific legal safeguards in place to prevent the costs of a potential data center bust from being socialized.

Financial Tools and Planning Failures

As ratepayers face the burden of existing stranded assets, financial mechanisms that could alleviate these costs remain underutilized in Wisconsin, while comprehensive planning to prevent future mistakes is nonexistent. One such tool is securitization, a process similar to refinancing a mortgage. It allows a utility to convert the debt of a stranded asset into a specialized bond with a lower interest rate than the utility’s standard profit margin, directly saving customers money. However, Wisconsin law is restrictive, permitting utilities to securitize only the cost of pollution control equipment, not the entire value of a retired plant. Even this limited option is voluntary, and utilities have often declined to use it. For instance, while We Energies used securitization for its Pleasant Prairie plant, saving customers an estimated $40 million, it refused to do so for the Oak Creek plant, forgoing potential savings of $117.5 million. Legislative efforts to expand securitization and make it mandatory have failed, blocked by industry opposition.

Compounding the problem is Wisconsin’s lack of a structured, forward-looking energy planning process. The state is one of the few that does not require utilities to develop an integrated resource plan (IRP), a comprehensive framework for forecasting future energy needs and evaluating the most cost-effective ways to meet them. Without IRPs, the PSC evaluates each proposed power plant in isolation, a piecemeal approach that encourages overbuilding and fails to consider the cumulative impact on the state’s energy system and ratepayers. States like Minnesota and Michigan mandate IRPs to ensure a more orderly and economically sound energy transition. Proposals by Governor Tony Evers to implement IRPs in Wisconsin have been consistently removed from the state budget by Republican lawmakers. This absence of a cohesive statewide energy strategy leaves Wisconsin vulnerable to repeating the same costly errors of the past, approving massive new projects without a clear understanding of their long-term necessity or financial consequences.

A Legacy Etched in Debt

The decisions made regarding Wisconsin’s energy infrastructure have cemented a financial reality that will burden its citizens for generations. The legacy of over-investment in coal, driven by a regulatory framework that incentivized building over efficiency, left a billion-dollar debt that was not easily shed. Despite the availability of financial tools like securitization that could have lessened the impact on ratepayers, their limited and optional application meant that significant opportunities for savings were lost. The failure to adopt comprehensive planning mechanisms like integrated resource plans ensured that the state continued to approve major energy projects in a reactive, fragmented manner. As the state stands on the cusp of a new energy-intensive industrial boom, the policies and precedents of the past have already set a course that risks history repeating itself, leaving the question of who will ultimately bear the cost hanging in the balance.