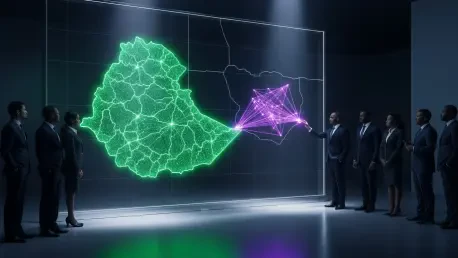

A high-stakes corporate confrontation has erupted in Ethiopia’s newly liberalized telecommunications sector, casting a shadow over the future of the nation’s competitive landscape. The dispute pits the long-standing state-owned incumbent, Ethio Telecom, against the market’s new entrant, Safaricom Ethiopia, in a conflict that began with accusations over mobile money services. Safaricom’s mobile money division, M-PESA, publicly claimed that Ethio Telecom was actively blocking its users from accessing the recently launched “Lehulm” mobile money application, suggesting a deliberate attempt to stifle competition. This allegation ignited a firestorm, prompting a swift and forceful response from Ethio Telecom, which vehemently denied any anti-competitive behavior. The incumbent operator framed its actions not as a blockade but as a necessary protective measure, asserting that it was safeguarding its critical infrastructure and customer base from what it described as “repeated infractions” and a clear “abuse of market conduct” by the newcomer. This clash goes beyond a simple technical issue, representing the first major test of the duopoly model established in 2022 after a century of monopoly rule.

The Heart of the Conflict

Accusations and Counter-Allegations

The core of the disagreement centers on profoundly different interpretations of market conduct and infrastructure utilization in a burgeoning competitive environment. Safaricom Ethiopia launched its M-PESA “Lehulm” application with the expectation of seamless interoperability, a standard feature in most competitive telecom markets. When users reported access issues, the company pointed the finger directly at the incumbent, framing the incident as an anti-competitive tactic designed to protect Ethio Telecom’s own mobile money services from a formidable new rival. However, Ethio Telecom presented a starkly contrasting narrative. CEO Firehiwot Tamiru articulated that the intervention was a direct response to Safaricom’s failure to adhere to established international standards and market regulations. The state-owned operator’s position is that a new market entrant must first invest in and establish its own robust digital infrastructure before attempting to leverage a competitor’s extensive customer network. Ethio Telecom categorized Safaricom’s approach as a premature and improper attempt to build its service on the back of the incumbent’s infrastructure, justifying its actions as a defense of its assets and a necessary enforcement of market discipline against a new player.

A Battle for Market Dominance

The conflict escalated significantly when Ethio Telecom moved beyond simple denials and issued a formal letter demanding a public apology from Safaricom Ethiopia for what it considered damaging and unfounded claims. This maneuver was more than a request for retraction; it was a clear assertion of dominance and a warning shot to the new competitor. Critically, the letter contained a stark threat: such “undisciplined disputes” posed a direct risk to the viability of the entire duopoly framework. Ethio Telecom warned that continued conflicts of this nature could force a reevaluation of the market liberalization, potentially leading to a reversion to the previous single-operator system. This statement highlighted the immense power the state-owned incumbent still wields. Although reports indicated that Safaricom did issue an apology to de-escalate the situation, Ethio Telecom has remained firm in its public stance. The company clarified that while it would not “share its customers,” it remained open to collaboration on future initiatives, provided they strictly adhere to market rules and international norms, effectively setting the terms for future engagement and reinforcing its position as the market’s primary gatekeeper.

Implications for Ethiopia’s Digital Future

The Fragility of a New Duopoly

This public spat has exposed the inherent fragility of Ethiopia’s transition from a century-old telecommunications monopoly to a competitive duopoly. The ambitious liberalization, which began just a few years ago, was intended to spur innovation, improve service quality, and lower prices for consumers by introducing market competition. However, this incident demonstrates that simply issuing a second license is not enough to guarantee a level playing field. The deep-rooted advantages of the incumbent, from extensive infrastructure and a massive customer base to significant political influence, create a complex power dynamic. Ethio Telecom’s threat to potentially scuttle the entire duopoly model reveals the precariousness of the new arrangement. Such instability could have a chilling effect on future foreign investment, as potential market entrants may become wary of the operational and political risks involved. The dispute underscores the critical need for a strong, independent regulatory body capable of mediating such conflicts impartially and enforcing clear, pro-competitive rules to ensure the long-term success of the liberalization agenda.

A Path Forward Amidst Uncertainty

The confrontation between Ethio Telecom and Safaricom Ethiopia ultimately served as a stark and necessary wake-up call for the nation’s burgeoning telecom sector. While an apology was reportedly tendered and the immediate crisis abated, the underlying tensions and structural challenges in the market remained. The incident highlighted the urgent need for clearer regulatory frameworks governing network interoperability, infrastructure sharing, and fair competition. It became evident that for a duopoly to thrive, a robust and independent dispute-resolution mechanism was not just a benefit but a necessity to prevent corporate disagreements from destabilizing the entire market. This foundational dispute forced both operators, as well as government regulators, to confront the complex realities of transitioning from a monopolistic past. The event underscored that fostering genuine, sustainable competition required more than just new licenses; it demanded a commitment to transparent rules and a level playing field, leaving the long-term health of Ethiopia’s digital future contingent on the lessons learned from this initial, turbulent test.