Setting the Stage for Telecom Transformation

In an era where connectivity defines economic and societal progress, network slicing stands out as a revolutionary force within the telecommunications sector, shaping the future of how we interact with technology. As of 2025, this technology—central to 5G standalone (5G SA) networks—has captured the attention of industry leaders, with 33 communications service providers globally offering slicing services. This striking adoption rate signals a pivotal shift toward customized network solutions, addressing diverse needs from enterprise applications to consumer demands. This market analysis delves into the latest trends, data, and projections surrounding network slicing, drawing on comprehensive industry reports to uncover its current impact and future potential. The purpose is to equip stakeholders with actionable insights into how this innovation is reshaping telecom markets and what lies ahead in this dynamic landscape.

Unpacking Market Trends and Data in Network Slicing

Rapid Commercial Adoption and Growth Metrics

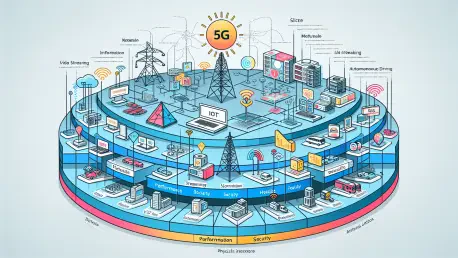

Network slicing has transitioned from a conceptual framework to a tangible market driver, with significant commercial traction evident in 2025. Reports indicate that 65 out of 118 identified use cases have moved from testing phases to live deployments, showcasing the technology’s viability across varied applications. Service providers are capitalizing on this by offering slicing as standalone subscriptions or add-on packages, catering to both individual users and businesses. This growth is closely tied to the global expansion of 5G SA networks, which enable the creation of multiple virtual networks on a single physical infrastructure. While this presents clear advantages in service customization, challenges such as high infrastructure costs and the complexity of managing virtual networks persist, requiring strategic investments to ensure scalability.

Enterprise Solutions as a Strategic Focus

Beyond consumer markets, network slicing is carving out a substantial niche in enterprise solutions, reflecting a broader industry pivot toward high-value services. Major operators are targeting corporate clients with tailored offerings, such as secure, low-latency networks for financial sectors or robust connectivity for industrial IoT applications. This shift aligns with ambitions to significantly boost business revenue, with some aiming for enterprise earnings to account for half of total income in the coming years. However, risks like cybersecurity threats in virtualized environments remain a concern, necessitating robust safeguards. Partnerships with industries to co-develop specific use cases are emerging as a promising avenue, ensuring solutions meet real-world demands and foster innovation.

Regional Disparities and Market Dynamics

The adoption of network slicing reveals stark regional variations, influenced by infrastructure readiness and economic priorities. In technologically advanced markets like the US, Japan, and South Korea, slicing is progressing swiftly, often integrated with national agendas for digital innovation. Conversely, in regions such as the Middle East, where smartphone shipments have surged by 23% year-over-year to 15.1 million units, the focus is on affordable 5G slicing to support consumer upgrades. Regulatory environments also play a critical role, with frameworks in areas like the European Union potentially accelerating or impeding progress based on their scope. Addressing these disparities through targeted investments and policy alignment will be essential to maximize slicing’s global reach and impact.

Emerging Applications and Sectoral Expansion

Another dimension of network slicing’s market influence lies in its application beyond traditional telecom into specialized sectors like defense and critical infrastructure. Collaborations involving AI-driven solutions for unmanned systems and surveillance highlight telecom’s growing role in security and logistics. This trend is fueled by increasing defense budgets and geopolitical demands, positioning telecom providers as dual-purpose players in civilian and military domains. Additionally, infrastructure upgrades to support societal shifts—such as enhanced connectivity for electric vehicle drivers along major highways—demonstrate how slicing adapts to emerging needs. These cross-sector applications underscore the technology’s versatility and its potential to drive growth in untapped markets.

Projections and Future Outlook for Telecom Markets

Anticipating the 6G Horizon

Looking ahead, the telecom industry is already gearing up for the next frontier with 6G technology, which promises to build on the foundations laid by network slicing. Projections suggest that global 6G subscriptions could reach 180 million by 2031, with early adoption concentrated in regions like the US, China, and Gulf Cooperation Council countries. These markets are poised to lead due to their robust technological ecosystems and investment capabilities. The integration of AI for network optimization and advanced data processing at the edge is expected to further enhance slicing capabilities, setting new benchmarks for connectivity and personalization in the years from 2025 to 2031.

Evolving Regulatory and Economic Influences

The future trajectory of network slicing will also be shaped by regulatory and economic factors that vary across geographies. In some regions, proposed policies aim to simplify rules for AI and related technologies, potentially easing the path for slicing adoption. However, industry feedback suggests that deeper support for digital ecosystems is still needed to fully unlock potential. Economic trends, such as rising defense spending and the push for sustainable technologies like electric vehicles, are likely to create additional demand for tailored network solutions. Navigating these influences will require agility from providers to align with both market needs and policy landscapes over the next few years.

Reflecting on Insights and Strategic Pathways

Looking back, the analysis of network slicing in 2025 reveals a transformative phase for the telecom industry, marked by robust adoption with 33 providers and 65 commercial use cases. The technology has proven its mettle in enterprise solutions, showcased regional disparities, and extended into diverse sectors like defense, while projections point to a significant leap with 6G by 2031. For stakeholders, the path forward involves prioritizing investments in 5G SA infrastructure to stay competitive, while forging strategic partnerships to address cybersecurity risks and market-specific needs. Service providers are encouraged to explore niche opportunities in emerging sectors, ensuring adaptability to regulatory shifts. As the market continues to evolve, the focus shifts to building collaborative ecosystems that can harness network slicing’s full potential, paving the way for a more connected and customized digital era.