In a continent where digital connectivity is rapidly becoming the backbone of economic progress, one company stands out as a beacon of transformation and resilience. MTN Group, a South African telecommunications titan listed on the Johannesburg Stock Exchange (JSE: MTN), has not only weathered past storms but has emerged as a driving force behind Africa’s technological awakening. With a remarkable financial turnaround and a bold strategic vision, MTN is shaping the future of digital access across diverse markets. This narrative delves into the key pillars of the company’s resurgence, from robust earnings and innovative platforms to its pivotal role in bridging the digital divide. As Africa’s appetite for data and fintech solutions grows, MTN’s journey offers a compelling glimpse into how a telecom giant can balance profitability with profound social impact, while navigating complex regulatory landscapes and positioning itself as a prime investment opportunity.

Financial Recovery and Growth

Stellar Performance in # 2025

The financial landscape for MTN Group in the first half of 2025 paints a picture of extraordinary recovery and strength, marking a significant pivot from previous challenges. Headline earnings per share soared to 645 cents, a dramatic shift from a loss of 256 cents in the same period last year, signaling a robust return to profitability. This achievement stems from a 23.2% surge in group service revenue, reaching R105.1 billion, with standout performances in data and fintech sectors showing growth rates of 36.5% and 37.3%, respectively. Such figures underscore the company’s ability to capitalize on evolving consumer demands, particularly in high-growth digital arenas. Beyond mere revenue, the jump in EBITDA by 60.6% to R46.7 billion reflects a deeper operational efficiency, as margins improved to 42.7% from a much lower base. This financial health not only highlights MTN’s pricing power in competitive markets but also its adeptness at managing costs while scaling services to meet Africa’s burgeoning needs.

Equally telling is the market confidence reflected in these numbers, which point to MTN’s strategic recalibration as a cornerstone of its success, especially as the company focuses on high-margin offerings in data services. This focus has offset declines in traditional voice revenue, ensuring a balanced portfolio that thrives amid industry shifts. Key markets like Nigeria have been instrumental, contributing a 54.1% revenue increase in constant currency terms, bolstered by stable exchange conditions and targeted pricing strategies. This regional strength, combined with a disciplined approach to expenditure, positions MTN as a leader capable of sustaining momentum. Investors and analysts alike see these results as evidence of a telecom entity that has not just recovered but redefined its growth trajectory. As digital adoption accelerates across the continent, MTN’s financial foundation suggests it is well-equipped to lead the charge, turning past setbacks into a springboard for future gains in a dynamic economic landscape.

Sustained Momentum and Market Impact

Another layer to MTN’s financial story is the broader impact of its performance on market perceptions and industry standards, reflecting how operational success can influence the telecom sector at large. The improved EBITDA margins are not just numbers on a balance sheet but a signal of operational maturity, showing how the company has streamlined processes to maximize returns. This efficiency is particularly crucial in a region where infrastructure costs are high and consumer purchasing power varies widely. By achieving such margins, MTN sets a benchmark for competitors, pushing the telecom sector toward greater accountability and innovation. The ripple effect of this financial discipline extends to shareholder value, with consistent returns reinforcing trust in the company’s long-term vision. As MTN continues to prioritize data-driven revenue streams, it reshapes expectations for what a telecom giant can achieve in emerging markets.

Furthermore, the financial turnaround has allowed MTN to reinvest in critical areas that promise sustained growth over the coming years, highlighting a forward-looking approach to development. The commitment to a capital expenditure range of R33 to R38 billion for the current year underscores this strategy, with funds directed toward expanding 5G capabilities and fiber networks in pivotal regions like Ghana. This investment is not merely about keeping pace with technology but about anticipating the needs of a continent where digital connectivity is increasingly synonymous with opportunity. The focus on infrastructure also mitigates risks associated with market saturation in urban centers by tapping into underserved rural areas. As MTN balances reinvestment with profitability, its financial strategy emerges as a model of resilience, ensuring that growth is both inclusive and sustainable. This dual focus positions the company as a catalyst for broader economic development across Africa.

Strategic Vision and Innovation

Ambition 2025: A Blueprint for Success

At the core of MTN Group’s transformation lies a strategic framework known as Ambition 2025, a visionary plan that redefines how a telecom company operates in a digital age. This approach pivots on a platform-centric model, where fintech, fiber, and digital services are managed as standalone entities with tailored capital structures, enabling faster decision-making and a sharper focus on growth sectors. By segmenting operations in this manner, MTN has unlocked agility, allowing each platform to innovate independently while contributing to the overarching goal of market leadership. This structure has proven particularly effective in accelerating expansion in data and financial services, areas where consumer demand is skyrocketing. The clarity of this blueprint ensures that resources are allocated efficiently, driving value in high-potential markets across the continent.

Equally significant is MTN’s decision to exit non-core regions such as the Middle East, redirecting focus and capital to Africa, where the digital economy holds immense promise. This strategic retreat, paired with a reduced net-debt-to-EBITDA ratio of 0.5x, down from a higher figure previously, reflects a commitment to financial prudence. The move has not only strengthened the balance sheet but also freed up resources for ambitious infrastructure projects, particularly in 5G and fiber connectivity. Key markets like Nigeria and South Africa benefit from this targeted investment, ensuring that MTN stays ahead of technological trends. With liquidity levels at R39.1 billion, the company is well-positioned to navigate economic fluctuations while pushing boundaries in innovation. Ambition 2025 thus emerges as more than a strategy; it is a declaration of intent to dominate Africa’s digital future through disciplined growth and forward-thinking initiatives.

Pioneering Infrastructure and Technology

MTN’s strategic vision extends beyond operational models to tangible investments that shape the continent’s technological landscape. The company’s increased capital expenditure guidance signals a bold commitment to building the infrastructure necessary for next-generation connectivity. Rolling out 5G networks in urban hubs and extending fiber to rural areas are priorities that address both current demands and future scalability. This dual approach ensures that MTN remains competitive in densely populated markets while also tapping into untapped regions where digital access can transform lives. Such initiatives are particularly impactful in countries like Ghana, where connectivity gaps remain significant, positioning MTN as a key enabler of economic inclusion through technology.

Moreover, the emphasis on infrastructure aligns with broader industry trends where data consumption is outpacing traditional services at an unprecedented rate. MTN’s proactive stance in upgrading networks prepares it to handle the exponential growth in data traffic driven by smartphone penetration and digital applications. This technological foresight is complemented by partnerships and innovations that enhance service reliability, ensuring minimal disruptions even in challenging environments. By prioritizing cutting-edge solutions, MTN not only strengthens its market position but also sets a standard for what connectivity should mean in Africa. The convergence of strategic planning and technological advancement under Ambition 2025 illustrates a company that is not merely adapting to change but actively defining it, paving the way for a connected continent.

Digital Inclusion and Service Delivery

Bridging the Digital Divide

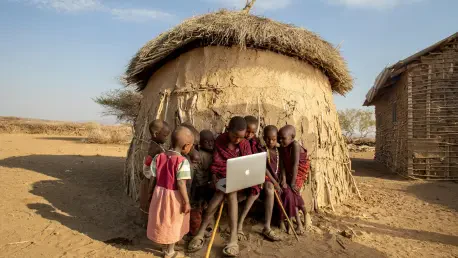

MTN Group’s mission transcends financial metrics, focusing heavily on narrowing Africa’s digital divide through innovative service delivery. Platforms like the Ayoba messaging app, boasting 20 million monthly active users, exemplify how the company creates accessible digital ecosystems that rival global counterparts. Similarly, MTN MoMo, a fintech service with 63.2 million active users, facilitates transaction volumes of 11.1 billion, amounting to a staggering $212.2 billion in value. These tools empower individuals and small businesses by providing seamless access to financial services, often for the first time, in regions where traditional banking is scarce. This commitment to inclusion is not just a corporate responsibility but a strategic differentiator, embedding MTN within the fabric of daily life across diverse communities.

Additionally, affordability remains a cornerstone of MTN’s approach to digital inclusion, ensuring that connectivity is within reach for the masses. Offering 10GB of data per month on a $20 smartphone is a deliberate move to democratize access, targeting widespread adoption among low-income populations. This initiative aligns with the broader vision of connecting Africa through extensive fiber and satellite networks, particularly in underserved rural areas. By prioritizing affordability alongside innovation, MTN addresses systemic barriers that have historically limited digital participation. The result is a growing user base that fuels revenue while fostering socio-economic progress, positioning the company as a transformative force. As digital literacy rises, MTN’s role in equipping millions with the tools for a connected future becomes increasingly vital, redefining what telecom leadership means in an emerging market context.

Empowering Communities Through Fintech

MTN’s impact on digital inclusion is perhaps most profound in the fintech space, where it has become a lifeline for millions lacking access to conventional financial systems. MTN MoMo stands as a testament to this, enabling users to save, send, and spend money with ease, thereby integrating them into the formal economy. This platform not only drives transaction volumes but also builds trust in digital payments, a critical step toward financial empowerment in cash-heavy societies. The scale of adoption highlights a pent-up demand for such services, particularly in remote areas where mobile money offers a secure alternative to physical cash. MTN’s ability to scale this solution across multiple markets showcases its operational depth and understanding of local needs.

Beyond individual users, MTN’s fintech initiatives support small and medium enterprises by providing tools for transactions and growth. This ripple effect stimulates local economies, as businesses leverage digital payments to expand their reach and efficiency. The company’s focus on user-friendly interfaces ensures that even those with minimal tech experience can participate, further broadening the impact. Partnerships with local governments and organizations also enhance the credibility and reach of these services, embedding MTN deeper into community frameworks. As fintech continues to evolve, MTN’s pioneering efforts position it at the forefront of a financial revolution, where mobile technology becomes synonymous with opportunity. This dual focus on accessibility and economic enablement underscores the company’s broader mission to uplift through connectivity.

Regulatory Landscape and Challenges

Supportive Reforms and Lingering Risks

The regulatory environment in Africa, particularly in South Africa, has provided a conducive backdrop for MTN Group’s expansive growth, with reforms like the Equity Equivalent Investment Programs (EEIPs) playing a key role. These programs have been instrumental, allowing global players to meet Black Economic Empowerment (B-BBEE) requirements through infrastructure investments rather than equity transfers. This shift has attracted significant foreign capital, accelerating the rollout of 5G networks and rural broadband initiatives. For MTN, these policies translate into tangible opportunities, enabling projects like fiber expansion and workforce training that align with national development goals. The resulting infrastructure improvements not only enhance service delivery but also strengthen the company’s competitive edge in a region hungry for connectivity.

However, the regulatory landscape is not without its complexities, presenting risks that stakeholders must carefully navigate, especially in the context of policy volatility that remains a significant concern. Shifts in political priorities could alter the favorable conditions currently benefiting MTN, creating uncertainty for the company and its investors. Criticism over the dilution of B-BBEE’s original intent—prioritizing empowerment through ownership—has sparked debates, with some arguing that infrastructure investments fall short of true equity goals. Such tensions could influence future reforms, especially ahead of upcoming elections, potentially impacting foreign investment flows. For MTN, maintaining adaptability in the face of these uncertainties is crucial, as regulatory changes could affect operational costs and market access. While the current environment supports growth, the potential for abrupt policy reversals serves as a reminder of the delicate balance between opportunity and risk in African markets.

Navigating Policy Uncertainties

Delving deeper into the regulatory challenges, MTN must contend with the broader implications of policy inconsistency across its operational footprint. While South Africa’s reforms offer a blueprint for progress, other African nations present varied regulatory frameworks, some less predictable or supportive. Inconsistencies in licensing requirements, taxation policies, and data protection laws can complicate expansion plans, requiring MTN to tailor strategies to each market. This fragmented landscape demands significant resources to ensure compliance, often diverting focus from core growth initiatives. Yet, the company’s experience in navigating such hurdles demonstrates a resilience that mitigates some of these risks, positioning it to influence policy dialogues through industry advocacy.

Moreover, the scrutiny over empowerment programs like B-BBEE highlights a broader societal expectation for corporations to drive meaningful change beyond infrastructure, emphasizing their role in social progress. MTN’s investments in rural connectivity and skills development are steps in this direction, but sustained dialogue with regulators and communities is essential to align corporate goals with public priorities. The potential for backlash against perceived foreign dominance in strategic sectors like telecom adds another layer of complexity, necessitating transparency in operations. As MTN continues to expand, its ability to balance regulatory compliance with strategic objectives will be a defining factor in maintaining growth momentum. The interplay of supportive reforms and inherent uncertainties underscores the nuanced environment in which the company thrives, shaping its approach to long-term stability.

Investment Appeal and Market Positioning

A Compelling Opportunity

For investors seeking exposure to emerging markets, MTN Group presents an attractive proposition that blends defensive stability with substantial growth potential. With a forward price-to-earnings ratio of 12x and a dividend yield of 4.5%, the company offers a valuation that appeals to both value and income-focused portfolios. These metrics, coupled with an upgraded revenue guidance projecting at least high-teens growth, reflect a business poised for consistent returns. MTN’s ability to generate robust free cash flow further enhances its appeal, providing the flexibility to fund ambitious projects while rewarding shareholders. As Africa’s digital economy gains traction, the company’s strategic focus on high-growth sectors like data and fintech positions it as a gateway to one of the world’s most dynamic regions.

Additionally, MTN’s alignment with Africa’s demographic trends amplifies its investment case, offering a unique entry point into a youthful, tech-savvy market. With a population increasingly reliant on digital tools for education, work, and commerce, the demand for MTN’s services is set to grow over the coming years. The company’s diversified revenue streams, spanning traditional telecom to innovative platforms, mitigate risks associated with market-specific downturns, ensuring resilience. This balance of stability and opportunity is rare in emerging markets, where volatility often overshadows potential. For global investors, MTN represents a calculated bet on a continent on the cusp of a digital revolution, underpinned by a management team that has demonstrated an ability to execute under pressure. The combination of attractive financials and macro trends makes a compelling argument for inclusion in forward-looking portfolios.

Shaping the Future of African Telecom

MTN’s market positioning extends beyond financial metrics, reflecting a broader influence on the trajectory of Africa’s telecom industry. By prioritizing data over voice services, the company mirrors a global shift while tailoring solutions to local realities, such as low-cost data bundles that drive adoption. This adaptability ensures MTN remains relevant as smartphone penetration surges, creating a virtuous cycle of user growth and revenue. The emphasis on fintech also places the company at the intersection of technology and finance, sectors with multi-decade growth horizons in Africa. Such positioning not only secures market share but also influences industry standards, pushing competitors to innovate or risk obsolescence in a rapidly evolving landscape.

Looking back, MTN’s journey through financial recovery, strategic restructuring, and digital innovation revealed a company that turned obstacles into stepping stones. The past efforts to streamline operations and invest in transformative platforms like MTN MoMo laid a foundation for enduring impact. Reflecting on these milestones, the focus now shifts to sustaining this momentum through continued investment in infrastructure and partnerships that amplify reach. As challenges like regulatory uncertainty persisted, the path forward involved deeper engagement with policymakers to shape a stable operating environment. For stakeholders, the next steps centered on monitoring MTN’s ability to scale innovations while navigating market complexities, ensuring that the legacy of resilience translated into a future of unparalleled connectivity across Africa.