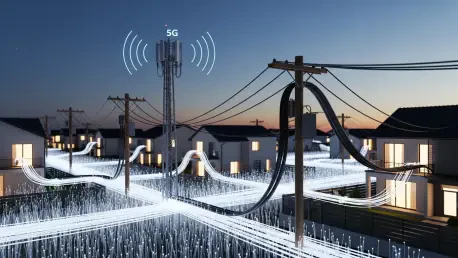

The once unshakeable foundation of the American cable industry has developed deep fissures, and the tremors originate from the wireless towers now dotting the landscape. Fixed Wireless Access (FWA) has stormed the broadband market, creating a competitive earthquake that has left established players reeling and analysts intensely debating the aftershocks. The technology’s rapid ascent from a niche offering to a formidable challenger is reshaping consumer choice and forcing a fundamental reevaluation of the internet access business. This roundup synthesizes market data, financial analysis, and technical assessments to explore the central paradox of FWits undeniable present-day success versus the profound questions surrounding its long-term endurance.

From Niche Player to Market Shaker: The Unfolding Story of Fixed Wireless Access

By 2025, Fixed Wireless Access has unequivocally shed its underdog label. Once relegated to serving rural areas beyond the reach of traditional wired infrastructure, it now stands as a mainstream broadband contender in suburban and urban markets across the country. This evolution represents more than just a new product offering; it signifies a tectonic shift in the competitive dynamics of an industry long defined by regional monopolies and duopolies. Millions of households have embraced FWA as a viable, and often more affordable, alternative for home internet, fundamentally altering the calculus for consumers and providers alike.

The significance of this transformation cannot be overstated, as it mounts the most serious challenge in a generation to the decades-long dominance of the cable industry. Mobile carriers, armed with expansive 5G networks, have successfully weaponized their wireless infrastructure to compete directly for home internet customers. This pivot from mobile-only services to a converged connectivity model has broken open a market that was, for many years, largely stagnant in its competitive structure, introducing new pricing pressures and service expectations.

At the heart of this industry-wide upheaval lies a critical investigation into FWA’s future. While its market momentum is currently a powerful force, it is propelled by a business model that faces fundamental questions of sustainability. The central conflict explored by industry experts is whether FWA’s explosive growth can be maintained as it confronts looming technical limitations and a precarious economic equation. Balancing its disruptive power against these foundational challenges is key to understanding the next era of American broadband.

The Anatomy of a Disruption: Growth, Consequences, and Cracks in the Foundation

The Cable Reckoning: How FWA Became the Industry’s “New Copper”

The rise of FWA has inflicted a severe and sustained subscriber drain on cable giants like Comcast and Charter Communications. These industry titans are now struggling to achieve, let alone maintain, positive broadband growth in a market they once commanded. The consistent quarterly reports of customer losses are a direct consequence of the aggressive market entry and competitive pricing of FWA services, which have successfully siphoned off a significant number of households seeking an alternative to their incumbent cable provider.

This trend has fostered a starkly bearish consensus among many financial analysts, who view the challenge from FWA and fiber as a permanent alteration of the market. Projections from some research firms suggest that major cable operators may not return to meaningful subscriber growth until after 2030. One of the most potent descriptions circulating in financial circles dubs FWA “the new copper,” drawing a parallel to how fiber optics rendered traditional telephone lines obsolete for data transmission. This perspective posits that the cable industry’s core business model is now “permanently impaired.”

However, this pessimistic outlook is not universally held. A more moderate contingent of experts offers a balanced perspective on cable’s future. While acknowledging the immense pressure from new competitors, this viewpoint suggests that cable operators can adapt and stabilize. Instead of a continuous, steep decline, their future may be one of flat or marginal growth, where they leverage their extensive infrastructure and bundling capabilities to retain a large, albeit no longer growing, customer base.

By the Numbers: Charting an Unprecedented Subscriber Landslide

The sheer scale of FWA’s growth is best illustrated through hard data. The “Big Three” mobile carriers have collectively amassed an impressive 14.65 million FWA subscribers, a testament to the service’s powerful market appeal. This subscriber landslide has been built quarter by quarter, demonstrating a consistent and aggressive expansion that has caught many legacy providers off guard and rewritten growth forecasts across the telecommunications sector.

Leading the charge, T-Mobile has showcased remarkable momentum, adding another 506,000 subscribers in the third quarter to reach a total of 8 million. Verizon has also continued its steady expansion, adding 261,000 customers to bring its base to 5.38 million. These figures are not an endpoint but a milestone; both carriers have articulated ambitious combined targets, aiming to serve up to 21 million households by 2028, signaling a deep and lasting commitment to the home internet market.

This rapid expansion presents a complex strategic picture for the mobile carriers. On one hand, it represents an enormous competitive opportunity to seize market share from entrenched cable and telephone companies, unlocking new revenue streams from their existing network investments. On the other hand, it introduces an existential risk to their core business. Effectively managing the massive data load from millions of home internet users without degrading the mobile experience for their primary smartphone customers is a delicate balancing act that will define their success.

The Looming Capacity Crunch: Is the FWA Juggernaut Running Out of Road?

Beneath the celebratory growth figures, a critical technical constraint challenges the narrative of infinite expansion: a potential network capacity ceiling. Unlike fiber optic cables with seemingly limitless bandwidth, wireless networks operate on a finite resource—radio spectrum. As carriers add more FWA customers in a given area, they consume more of this capacity, raising serious questions about how many households a single cell tower can realistically serve without performance degradation.

This concern is supported by detailed network modeling from industry analysts. One prominent estimate from New Street Research suggests that the U.S. FWA industry has enough total network capacity to support approximately 32 million subscribers nationwide. Crucially, the same analysis indicates that about 55% of this total capacity has already been consumed by the current subscriber base. This finding implies that carriers are much closer to a growth limit than their marketing suggests.

The future implications of this finite limit are profound. As carriers pursue their ambitious subscriber targets, they risk running headlong into this capacity wall. To continue growing without significant new spectrum or technological breakthroughs, they may be forced to compromise on service quality. This could lead to slower speeds and higher latency for all users on the network—both FWA and mobile—potentially undermining the very value proposition that fueled their initial success.

The Profit Paradox: When Massive Traffic Fails to Generate Major Revenue

Further complicating the long-term outlook is a glaring economic imbalance that some have termed the “profit paradox.” Analysis reveals a yawning mismatch between the enormous volume of data consumed by FWA services and the minimal revenue they contribute to the carriers’ bottom lines. FWA customers use their connections like any other home broadband user, streaming video, gaming, and downloading large files, placing a heavy load on the mobile network.

A comparative analysis from MoffettNathanson’s findings starkly illustrates this disparity. For Verizon, FWA is estimated to account for roughly half of all traffic on its wireless network, yet it generates only 3% of the company’s wireless service revenue. The situation is even more pronounced for T-Mobile, where FWA reportedly represents two-thirds of all network traffic but contributes just 6% of service revenue. This lopsided economic model treats network capacity as a nearly free resource, which is fundamentally unsustainable.

This profound imbalance probes the core of FWA’s long-term economic viability. While the current strategy is effective for rapidly acquiring market share, it has prompted what one report calls “very significant questions” about whether it can ever become a truly profitable enterprise on par with mobile services. This revenue-to-traffic discrepancy stands as the most significant question hanging over the FWA business model, forcing the industry to consider if it is a sustainable revolution or a temporary, loss-leader strategy.

Navigating the FWA Crossroads: Strategic Imperatives for a Reshaped Market

The collected evidence paints a clear picture: FWA is a powerful and legitimate market disruptor, but one whose astonishing success is built upon a potentially fragile economic and technical foundation. The collision of rapid subscriber growth with the realities of finite network capacity and disproportionately low revenue places the entire FWA segment at a strategic crossroads. Its future trajectory depends less on market demand and more on the ability of carriers to solve these fundamental structural challenges.

For mobile carriers, the path forward requires a pivot from aggressive acquisition to sophisticated management. This includes implementing advanced network management tools to prioritize traffic and optimize performance, ensuring that the heavy data demands of FWA do not compromise the core mobile experience. Furthermore, exploring tiered pricing models based on speed or data consumption could be essential to closing the revenue gap and aligning the service’s economic contribution with its resource utilization.

Simultaneously, cable operators must execute a robust survival playbook centered on their inherent technological advantages. The most critical imperative is accelerating the deployment of fiber-to-the-home, which offers demonstrably superior speed and capacity. This must be paired with a strategic focus on service bundling—combining high-speed internet with mobile and television services—to create a sticky ecosystem that FWA providers cannot easily replicate. Finally, marketing efforts must hammer home the message of superior reliability and performance, highlighting the stability of a wired connection versus the potential variability of wireless.

Beyond the Hype: The Enduring Legacy of FWA in the Next Broadband Era

The central conclusion of the 2025 broadband market analysis was that FWA had permanently altered the competitive dynamics of the industry, regardless of the ultimate form its business model took. It successfully shattered the long-standing equilibrium, proving that a viable, mainstream alternative to cable was not only possible but highly desired by a significant portion of the American public. The era of comfortable duopolies had definitively ended.

This disruption ensured that the defining force shaping the future of American internet access was the ongoing battle between FWA, cable, and fiber. Each technology brought distinct advantages to the table—FWA’s flexibility and ease of installation, cable’s widespread incumbency and bundling power, and fiber’s unparalleled performance. This three-way competition created a more dynamic and consumer-friendly market than had existed at any point in the prior decade.

Ultimately, the industry was left to grapple with whether FWA was a sustainable revolution in its own right or a brilliant but temporary market-share play. Its lasting legacy was that it forced a new economic and technological equilibrium. Every provider, new and old, had to re-evaluate its pricing, upgrade its network, and innovate its services to compete in a world where consumers finally had a real choice.