The once-predictable landscape of Italian telecommunications is being dramatically redrawn, not by a single company’s ambition, but by an unprecedented alliance between its two largest operators. This landmark preliminary agreement between TIM and the newly formed Fastweb+Vodafone entity signals a fundamental shift in market strategy, moving from pure competition to strategic collaboration to tackle the immense challenge of next-generation network deployment.

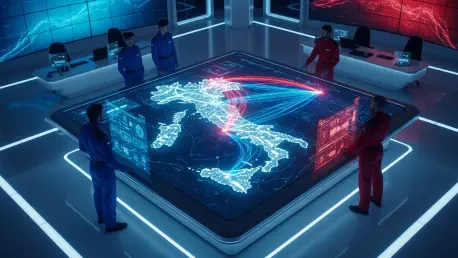

Redrawing Italy’s Digital Map A New Era of Telecom Collaboration

This partnership represents a seismic event in Italy’s telecom sector, setting the stage for a new cooperative paradigm driven by shared economic and strategic imperatives. The agreement is a direct acknowledgment that the high costs and logistical complexities of building a nationwide 5G network demand innovative solutions. It reflects a maturing market where infrastructure efficiency has become as critical as competitive service offerings.

At its core, the alliance is designed to accelerate 5G deployment and close the persistent digital divide between Italy’s urban centers and its less populated rural regions. By pooling resources, the operators aim to bring high-speed connectivity to underserved communities far more quickly than either could alone. This move reshapes the very foundation of competition, shifting the battleground from network footprint to the quality of services, customer experience, and innovation built atop the shared infrastructure.

Dissecting the Strategic Calculus Behind a Landmark 5G Partnership

The Blueprint for Shared Dominance Unpacking the 15,500 Site RAN Agreement

The operational heart of the deal is a comprehensive Radio Access Network (RAN) sharing plan set to cover 15,500 sites by the end of 2028. This infrastructure, a mix of new and existing towers, will specifically target municipalities with fewer than 35,000 residents across ten key Italian regions. Each operator will build and manage half of these sites, including active components like antennas and baseband units, while granting the other full access, creating a unified rural network without redundant investment.

This model is meticulously crafted to drive capital efficiency and eliminate the costly duplication of infrastructure that has historically defined network rollouts. Critically, however, the agreement allows both TIM and Fastweb+Vodafone to maintain complete commercial and technological autonomy, enabling them to compete fiercely on service quality and innovation. Before the rollout can commence after the final contract is signed, the deal must navigate a significant regulatory approval process involving MIMIT, AGCM, and AGCom.

A Market Remade How Swisscom’s Takeover and Rival JVs Paved the Way for Alliance

This alliance cannot be viewed in isolation; it is a direct strategic countermove within a recently transformed market. The catalyst was Swisscom’s acquisition of Vodafone Italia, which created the powerhouse Fastweb+Vodafone entity and instantly made it the country’s largest mobile operator with 33.1 million subscribers. This consolidation immediately altered the competitive balance, compelling former market leader TIM to find new ways to reinforce its position.

Moreover, the collaborative model is not entirely new to Italy, providing a proven template for the partnership. Competitors WindTre and Iliad had already established a similar 50-50 joint venture, Zefiro Net, demonstrating the viability of network sharing. For TIM and Fastweb+Vodafone, this alliance is therefore not just an offensive move to accelerate 5G but also a defensive necessity to achieve the scale and efficiency needed to compete against a field of increasingly consolidated rivals.

Beyond the Handshake Navigating Internal Pressures and Parallel Strategic Plays

The partnership arrives as both operators navigate complex internal transformations, adding another layer of strategic depth to the deal. For the new Fastweb+Vodafone entity, the external collaboration runs in parallel with the monumental task of integrating two disparate legacy networks and IT systems. Success hinges on its ability to manage both internal and external integration projects simultaneously.

For TIM, the alliance coincides with a notable strategic pivot in its vendor relationships, having recently awarded a major 5G expansion contract to Nokia. This suggests a broader recalibration of its supply chain, potentially reducing its reliance on other European suppliers. The 5G sharing agreement is thus a single, albeit crucial, piece in a larger puzzle of corporate strategy focused on cost optimization, technological modernization, and long-term competitive positioning.

The New Telecom Playbook Why Co-opetition is an Industry Imperative

The TIM and Fastweb+Vodafone deal is a prime example of a global trend toward “co-opetition,” where direct competitors collaborate on infrastructure to manage the staggering costs of 5G. The capital expenditure required for next-generation networks is so immense that few operators in mature markets can justify shouldering the burden alone, particularly for less profitable rural areas. This model is seen by industry analysts as an essential tool for sustainable growth.

Compared to other European network-sharing models, the Italian approach balances deep infrastructure collaboration with a strict separation of commercial activities. While this preserves vibrant competition for consumers, it requires robust governance to manage the inherent complexities. Ultimately, this paradigm shift suggests a future where the basis of competition moves away from who owns the most towers and toward who can deliver the most innovative and valuable services over a shared network fabric.

Key Imperatives and Strategic Lessons from the Italian 5G Alliance

The core drivers behind this landmark agreement provide a clear blueprint for the industry: accelerating rural coverage, optimizing massive capital expenditures, and mounting a strategic response to market consolidation. These three imperatives have converged to make collaboration not just an option, but a necessity for survival and growth in the Italian market. The alliance serves as a case study in how to pursue aggressive network expansion while maintaining fiscal discipline.

Industry leaders recognize that for such agreements to succeed, they must be structured to balance collaborative efficiency with competitive independence. Best practices emerging from this and similar deals emphasize clear governance, equitable investment responsibilities, and technological neutrality. This ensures that while the underlying infrastructure is shared, each operator retains the freedom to differentiate its products and innovate independently, preventing market stagnation.

Forging the Future The Lasting Impact on Italy’s Connectivity and Competitive Dynamics

This agreement demonstrated that strategic collaboration had become the definitive tool for navigating the high-stakes 5G era in Italy. By prioritizing shared infrastructure, the nation’s leading operators acknowledged a new reality where partnership is essential for achieving ubiquitous connectivity and unlocking the full potential of the digital economy.

The long-term implications for Italy are profound, promising accelerated digital transformation for businesses and enhanced services for consumers, particularly outside major urban hubs. The success of this venture could also pave the way for future network-sharing initiatives, potentially extending to other areas of telecom infrastructure. As infrastructure becomes a shared commodity, how will Italy’s telecom titans redefine victory in the battle for the end customer?