A Surprising Twist in the Cord-Cutting Saga

For the better part of a decade, the narrative surrounding pay television has been one of relentless decline. Yet, in a striking turn of events, the industry just posted its first net subscriber gain in eight years, raising a tantalizing question: is this a temporary blip or the start of a genuine comeback? The latest market data reveals a sector in deep transition, where the meteoric rise of streaming-based TV bundles is beginning to offset the persistent bleed from traditional cable and satellite. This article will dissect this apparent inflection point, exploring the forces driving the numbers, the innovative strategies stabilizing the market, and whether pay-TV is truly being reborn or simply finding a new, more sustainable form.

The Long Shadow of Cord-Cutting: A Decade of Decline

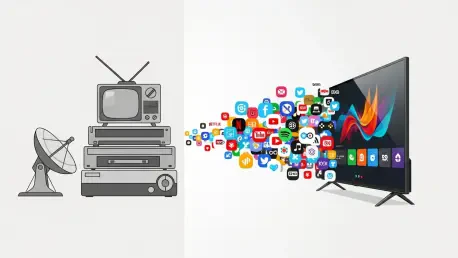

To understand the significance of today’s market shift, one must first appreciate the long-standing industry trend it defies. The rise of on-demand streaming services created a generation of “cord-cutters” and “cord-nevers” who abandoned costly, inflexible cable and satellite packages for the freedom of à la carte entertainment. This exodus triggered a consistent and often accelerating erosion of the traditional pay-TV subscriber base, with providers losing millions of customers year after year. This historical context is essential, as it highlights why the recent positive subscriber report has sent shockwaves through the media world and why the industry is so urgently seeking a new playbook for survival and relevance in the modern streaming era.

Deconstructing the Numbers: A Market in Transition

The Tipping Point: A Modest Gain with Major Implications

The latest report from MoffettNathanson for the third quarter of 2025 serves as the catalyst for this re-evaluation. The U.S. pay-television market recorded a net gain of 303,000 subscribers, bringing the total number of households to 64.77 million. While a modest figure, this marks the first quarterly increase in eight years, representing a significant psychological and financial turning point for an industry long defined by subscriber erosion. The gain signals not a revival of the old model but a critical rebalancing act, where explosive growth in one segment is finally strong enough to counteract the long-standing losses in another.

The Tale of Two Tiers: Virtual Ascendance and Traditional Resilience

The positive headline figure masks a deep division within the industry. The growth was driven entirely by virtual multichannel programming distributors (vMVPDs)—streaming services like YouTube TV that replicate traditional channel bundles. This modern segment added an impressive 1.42 million subscribers, with an estimated 750,000 of those gains coming from YouTube TV alone. At the same time, traditional operators—cable, satellite, and telephone companies—continued to shed customers, losing a combined 1.12 million. However, this loss represents a substantial improvement over the 1.63 million subscribers lost in the same quarter last year, suggesting the decline in the legacy business is finally starting to slow.

The NFL Effect: A Seasonal Boost or Sustainable Growth

Despite the encouraging figures, a heavy dose of cautious optimism prevails. Analysts are quick to point out that the Q3 gains were significantly influenced by seasonal factors, most notably the start of the NFL regular season, a key driver for live sports subscriptions. There is a legitimate concern that these new subscribers are fair-weather fans who may churn once the football season ends. As analyst Craig Moffett noted, while it is “too early to declare victory,” the results provide the first real “reason for optimism” in years. This sentiment perfectly captures the industry’s mood: hopeful but acutely aware that the gains could be fleeting.

The New Playbook: Redefining the Value of the Bundle

The nascent turnaround isn’t happening in a vacuum; it’s being fueled by a clear strategic shift away from defending the old model and toward reinventing the bundle for the streaming age. Charter Communications stands out as a prime example, having dramatically reduced its quarterly subscriber loss from 294,000 to just 70,000 in one year. This was largely credited to its innovative strategy of bundling major direct-to-consumer (DTC) streaming apps directly into its pay-TV packages at no extra cost. This approach makes the traditional video package more compelling and valuable, positioning it as a “super-bundle” that simplifies a fragmented media landscape for the consumer. While not all providers have followed suit, others like Comcast are also adapting by introducing simplified national packages to reduce complexity and improve the customer experience.

Navigating the Evolving Landscape: Key Strategies and Outlook

The primary takeaway from the recent data is that the pay-TV market is not dying but transforming into a hybrid ecosystem. The growth is now firmly in the hands of vMVPDs, while traditional providers are finding a potential lifeline in innovative bundling strategies that embrace, rather than fight, the streaming revolution. For providers, the path forward requires a focus on aggregation and value, offering consumers simplified, high-value packages that integrate the best of linear and on-demand content. For consumers, it means the value proposition of pay-TV is changing, evolving from a rigid channel package into a centralized hub for managing their entertainment subscriptions.

The Verdict: A Reshaping, Not a Revival

Ultimately, the recent positive subscriber numbers did not signal a return to the glory days of cable television. Instead, they marked a fundamental reshaping of the pay-TV landscape, where the very definition of the service is expanding to include its virtual, streaming-based counterparts. The industry is slowly learning to co-exist with and even leverage the streaming giants it once viewed as an existential threat. The battle is no longer a zero-sum game of cable versus streaming but a race to become the most compelling and convenient entertainment aggregator. As the lines between television formats continued to blur, the ultimate winner would be the platform that best mastered the art of the bundle, turning today’s content chaos into tomorrow’s seamless viewing experience.