What happens when a telecommunications powerhouse, built on the promise of revolutionizing connectivity, is forced to dismantle its grandest dreams? EchoStar, a titan in satellite and wireless services, stands at this very precipice, compelled by regulatory storms and financial pressures to abandon its vision of becoming a major U.S. mobile operator. With billions in spectrum deals and a redefined business model, the company’s dramatic pivot raises a pressing question: can a legacy player adapt fast enough to thrive in an era of relentless innovation? This story unfolds at the volatile crossroads of technology, policy, and market survival, offering a window into the challenges shaping modern communication.

Why EchoStar’s Strategic Shift Demands Attention

The significance of EchoStar’s current transformation extends far beyond corporate boardrooms. This is a tale of an industry giant grappling with the weight of regulatory oversight from the Federal Communications Commission (FCC), which has scrutinized the company’s compliance with 5G obligations, effectively stalling its operations. The stakes are high—failure to adapt risks not just financial collapse but also diminished access to cutting-edge connectivity for millions of consumers. EchoStar’s response, marked by bold asset sales and strategic alliances, mirrors broader tensions in telecom over spectrum scarcity and the cost of next-gen networks, making this pivot a critical case study for the sector’s future.

Regulatory Roadblocks and Financial Crunch: The Catalysts of Change

At the core of EchoStar’s upheaval lies a perfect storm of external pressures. The FCC’s investigation into the company’s spectrum license rights and 5G commitments has been described by leadership as a paralyzing force, pushing EchoStar to the edge of bankruptcy. Unable to sustain the capital demands of building a nationwide network, the company has been compelled to rethink its foundational goals. This regulatory bind isn’t unique to EchoStar—it reflects systemic challenges in balancing innovation with compliance, where government oversight can reshape entire business landscapes overnight.

Financial realities have compounded these woes, forcing tough decisions. With mounting debts and frozen operations, EchoStar could no longer cling to its ambition of being the fourth facilities-based mobile operator in the U.S. Instead, the focus has shifted to survival through liquidity, a move that underscores the harsh trade-offs companies face when long-term visions collide with short-term crises. This backdrop sets the stage for a radical reorientation of strategy, driven by necessity rather than choice.

Spectrum Sales and Partnerships: A New Blueprint for Survival

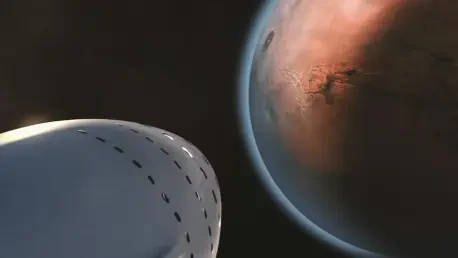

EchoStar’s response to these challenges is a multifaceted overhaul, starting with significant spectrum transactions. In a pivotal deal, the company sold mid-band and low-band spectrum to AT&T, enabling it to decommission its own 5G network and transition to a hybrid Mobile Virtual Network Operator (MVNO) model using AT&T’s infrastructure. A separate $17 billion agreement with SpaceX for AWS-4 and H-block spectrum, paid in cash and stock, not only injects vital funds but also secures access to SpaceX’s direct-to-device (D2D) technology for future customer offerings. These sales mark a stark departure from infrastructure ownership to a leaner, partnership-driven approach.

Beyond spectrum, EchoStar is redefining its wireless arm, Boost Mobile, which boasts 7.36 million subscribers as reported in recent quarters. Now operating on AT&T’s network while retaining its cloud-based core, Boost is positioned as a “challenger brand” aimed at disrupting the market through agility. Leadership highlights the upcoming integration of SpaceX’s D2D capabilities as a game-changer, promising innovative connectivity solutions that could set Boost apart in a crowded field. This shift emphasizes adaptability over brute scale, a calculated bet on niche impact.

Meanwhile, Hughes Network Systems, EchoStar’s satellite broadband unit, is pivoting from residential to enterprise services to counter competition from low-Earth orbit (LEO) giants like Starlink. Targeting 50% of revenue from enterprise clients within the next few years, Hughes has secured contracts with Delta Airlines and Turkish carrier Ajet for resilient connectivity blending satellite and terrestrial tech. This move reflects a strategic narrowing of focus, aiming to carve out a defensible space in a hyper-competitive arena where differentiation is key.

Leadership Perspectives: Navigating a Reluctant Transformation

Insights from EchoStar’s top executives reveal the tension and pragmatism behind this forced pivot. Speaking at a prominent industry event in Paris, CEO Hamid Akhavan candidly labeled the shift as a “forced pivot,” admitting that liquidating spectrum assets was far from ideal but necessary for financial stability. His words carry the weight of a leader steering through uncharted waters, balancing regret with the urgent need to stabilize the company’s footing in a turbulent market.

Chairman Charlie Ergen, on the other hand, pointed to the silver lining of EchoStar’s remaining spectrum holdings, which he believes will appreciate in value over time. He emphasized ongoing discussions with the FCC to ensure flexibility in utilizing these assets, especially as the agency contemplates reallocating 800MHz of spectrum. Ergen’s optimism aligns with industry trends valuing spectrum as a scarce, critical resource, suggesting that EchoStar’s strategic retreat could still yield long-term leverage. These leadership voices collectively paint a picture of resilience, underpinned by a realistic grasp of the constraints at play.

Lessons from EchoStar: Adapting Under Pressure

EchoStar’s journey offers valuable takeaways for businesses facing similar crises in heavily regulated or capital-intensive sectors. First, prioritizing liquidity can be a lifeline, as seen in the spectrum sales to AT&T and SpaceX, which provided immediate relief even at the cost of original ambitions. This approach highlights the importance of short-term survival as a foundation for eventual recovery, a lesson applicable across industries under financial strain.

Strategic partnerships also emerge as a powerful tool for scalability without the burden of infrastructure costs. EchoStar’s MVNO model with AT&T demonstrates how alliances can preserve market presence while reducing operational overhead, a tactic worth considering for companies needing to pivot quickly. Additionally, focusing on niche disruption, as Boost Mobile aims to do with innovative offerings, shows the value of targeting specific customer needs to stand out in saturated markets. Finally, diversifying revenue streams, like Hughes’ enterprise pivot, underscores the need to explore adjacent sectors where existing expertise can create new opportunities. These strategies, drawn from EchoStar’s real-time adaptations, provide a blueprint for navigating uncertainty with a blend of caution and creativity.

Reflecting on EchoStar’s Path: What Came Next

Looking back, EchoStar’s forced pivot stood as a defining moment, a testament to the brutal realities of regulatory and financial headwinds that reshaped its trajectory. The spectrum deals with AT&T and SpaceX had provided the necessary breathing room, allowing the company to step back from the brink and refocus on asset-light, partnership-driven models. Boost Mobile’s repositioning as a market disruptor and Hughes’ enterprise shift had begun to show early signs of promise, even as uncertainties around video business consolidations lingered.

For stakeholders and industry observers, the next steps involved closely monitoring how EchoStar leveraged its remaining spectrum and strategic alliances. Exploring further partnerships to enhance D2D offerings for Boost customers emerged as a priority, alongside navigating FCC rulings on spectrum flexibility. Beyond that, the potential for mergers in the video segment offered a wildcard worth watching. EchoStar’s experience had illuminated a broader truth: adaptation, though born of necessity, could forge a path to renewed relevance if paired with relentless innovation and strategic foresight.