The rapid ascent of artificial intelligence has transformed the tech landscape, creating an insatiable demand for robust data center infrastructure to support complex computational needs, and Coherent (COHR) is emerging as a pivotal player in this high-stakes arena. As a high-beta investment, this company offers the tantalizing prospect of substantial returns for those willing to embrace volatility, fueled by its strategic focus on AI-driven data center expansion and telecom innovation. COHR specializes in photonics and optical components, the unsung heroes of high-speed connectivity that power the backbone of modern AI technologies and communication networks. With the global push for faster, more efficient data processing intensifying, the company stands at the intersection of cutting-edge innovation and market demand. This article explores the factors positioning COHR as a compelling opportunity, from its technological advancements to financial momentum, while also weighing the inherent risks of such a dynamic investment in a rapidly evolving sector.

Aligning with Industry Megatrends

The tech industry is undergoing a seismic shift, with AI applications like generative models and large language processing driving an unprecedented need for enhanced data center capabilities, and COHR is strategically positioned to capitalize on this momentum. The surge in AI workloads requires infrastructure that can handle massive data throughput, placing optical interconnects and high-speed components at the heart of this revolution. COHR has astutely aligned itself with these megatrends by prioritizing high-margin photonics markets, a move underscored by its divestiture of non-core operations, such as the aerospace and defense segment, for $400 million in the second quarter of the current fiscal year. This refocusing allows for greater investment in research and manufacturing tailored to AI and telecom needs. Furthermore, a rumored partnership with a major tech giant for VCSEL products strengthens its domestic manufacturing presence, enhancing its ability to meet the growing demands of cloud infrastructure and consumer electronics sectors with innovative solutions.

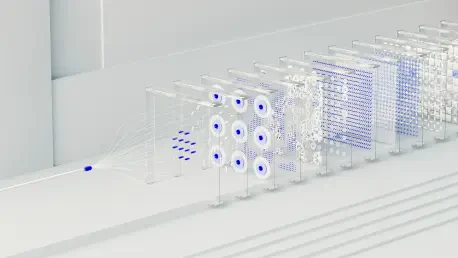

Beyond mere alignment with trends, COHR is actively shaping the future of connectivity through operational advancements that promise scalability and cost efficiency. A prime example is the development of a 6-inch indium phosphide wafer fabrication facility, a significant leap that boosts device output per wafer while cutting die costs by over 60%. This isn’t just a technical achievement; it’s a strategic one, enabling the company to offer competitive pricing and meet the escalating volume requirements of data center operators. Such initiatives reflect a forward-thinking approach to addressing the bottlenecks in AI infrastructure, where speed and capacity are paramount. As the industry races to support increasingly complex algorithms and data-intensive applications, COHR’s emphasis on photonics positions it as a critical supplier in an ecosystem hungry for reliable, high-performance solutions, setting the stage for sustained growth in a competitive market.

Pioneering High-Speed Connectivity Solutions

At the core of COHR’s appeal lies its technological leadership in 800G transceivers, a breakthrough addressing the urgent bandwidth needs of AI data centers grappling with exponential data growth. Launched in September of last year, the L-band 800G ZR/ZR+ coherent pluggable transceiver in a QSFP-DD form factor represents a milestone, doubling fiber capacity to an impressive 64 Tbps while eliminating the need for external amplifiers or filters. Built on indium phosphide technology, this innovation not only enhances performance but also slashes operational costs for data center operators, offering a clear advantage over alternatives like silicon photonics. This positions COHR as a go-to supplier for infrastructure upgrades, directly responding to the real-time demands of AI-driven environments where latency and throughput can make or break operational efficiency, cementing its reputation as a frontrunner in connectivity solutions.

This technological edge is more than a competitive differentiator; it’s a response to a critical market gap where speed equates to survival in the AI race. Data centers supporting advanced machine learning models require interconnects that can keep pace with skyrocketing computational loads, and COHR’s advancements deliver precisely that. The cost savings from streamlined hardware needs further sweeten the deal for clients under pressure to optimize budgets without sacrificing performance. Unlike peers who may focus on software or analytics, COHR’s hardware-centric approach ensures it plays a foundational role in the physical layer of AI ecosystems, a layer that remains indispensable regardless of software innovations. As AI applications continue to proliferate across industries, from healthcare to finance, the reliance on such cutting-edge optical components will only deepen, reinforcing COHR’s pivotal position in this high-growth space.

Financial Momentum and Competitive Standing

Turning to the numbers, COHR’s financial performance reflects a company riding a wave of robust demand in key growth areas like networking and datacom. In the third quarter of the current fiscal year, revenue in these segments reached $897 million, a striking 24% increase compared to the previous year, while total revenue for the second quarter hit $1.43 billion, underscoring strong market traction. Management’s projections add to the optimism, forecasting a 23% revenue uptick and an eye-popping 191% rise in non-GAAP earnings per share for the full fiscal year. These figures highlight not just growth, but the potential for scalability in a sector where demand shows no signs of slowing. Against this backdrop, COHR’s focus on hardware for AI infrastructure offers a distinct angle for investors compared to software-heavy competitors, blending financial strength with strategic market positioning.

When stacked against peers, COHR’s unique value proposition becomes even clearer, particularly in the context of AI ecosystem roles. Compared to a company like Palantir, which posted $1.004 billion in revenue for Q2 of the current fiscal year with a focus on AI software for defense and intelligence, COHR’s hardware emphasis provides a more tangible, enduring foundation for data center needs. Similarly, Amplitude, with $320 million in annual recurring revenue in Q1, operates in customer analytics SaaS, lacking the capital-intensive innovation that defines COHR’s photonics business. For investors seeking exposure to the physical infrastructure underpinning AI’s growth, COHR emerges as a standout option. Its financial metrics, paired with analyst endorsements like a “Buy” rating and a $120 price target suggesting over 22% upside, paint a picture of a company not just keeping pace, but gaining ground in a fiercely competitive landscape.

Balancing Risks with High-Reward Potential

High-beta investments inherently carry volatility, and COHR faces challenges that temper its otherwise bullish outlook, notably in financial structure and market dynamics. A significant debt burden looms as a potential constraint on flexibility, limiting the company’s ability to pivot swiftly in response to unforeseen market shifts or to fund expansive growth initiatives without added strain. Additionally, the absence of a definitive economic moat leaves it vulnerable to aggressive competition from both established players and nimble startups eyeing the lucrative AI infrastructure space. These factors demand careful consideration from investors, as they could impact short-term stability even amidst promising long-term trends, requiring a nuanced approach to evaluating the company’s risk-reward profile in a fast-moving industry.

Yet, these risks are not without counterweights, as COHR’s strategic advantages offer a buffer against such headwinds, providing a pathway to navigate competitive pressures. The first-mover status in 800G transceiver technology stands as a critical edge, allowing the company to set industry benchmarks before rivals catch up. Ongoing innovations, like cost-reducing manufacturing processes, further insulate it from margin erosion that often plagues hardware-focused firms. Analyst confidence, reflected in optimistic price targets and ratings, suggests that the market sees these strengths as outweighing immediate concerns. For investors, the task lies in weighing this innovation-driven resilience against financial and competitive vulnerabilities, recognizing that the potential for outsized returns in AI data center growth comes with the need for patience and a tolerance for near-term fluctuations in performance and market sentiment.

Charting the Path Forward After Strategic Gains

Reflecting on the journey so far, COHR carved a notable path by realigning its operations toward high-margin photonics markets, a decision that paid dividends in capturing the surging demand for AI data center solutions. The bold divestiture of non-core segments redirected vital resources to innovation, while breakthroughs in 800G transceivers established a benchmark for high-speed connectivity. Financially, the company demonstrated impressive growth, with substantial revenue increases signaling market confidence. Despite navigating risks like debt and competition, strategic moves mitigated some of these pressures, positioning COHR as a key player in telecom and AI infrastructure. Looking ahead, stakeholders should monitor how the company leverages its technological lead to expand market share, while addressing financial constraints through prudent capital management. Exploring further partnerships and scaling manufacturing innovations could solidify its standing, offering a roadmap for sustained impact in a sector poised for exponential growth.