The New Space Race: Redefining Mobile Connectivity from Orbit

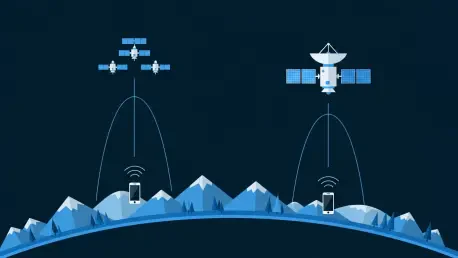

The long-held dream of eliminating mobile “dead zones” is rapidly becoming a reality, sparking a fierce technological rivalry among America’s top wireless carriers. At the heart of this new frontier is the race to deliver direct-to-device (D2D) satellite service, promising to connect standard smartphones even in the most remote locations. While T-Mobile, powered by its partnership with Starlink, has established a significant first-mover advantage, AT&T is mounting an ambitious counteroffensive with its technologically advanced partner, AST SpaceMobile. This article explores the high-stakes battle for satellite supremacy, analyzing whether AT&T’s calculated bet on superior technology can overcome T-Mobile’s crucial head start and reshape the future of ubiquitous connectivity.

Setting the Stage: How Satellite Connectivity Became a Carrier Imperative

For decades, the promise of “nationwide coverage” from mobile carriers came with an unspoken asterisk, excluding vast rural and wilderness areas where cell towers were impractical. This limitation was accepted as a simple fact of life. However, the maturation of low-Earth orbit (LEO) satellite constellations has shattered this paradigm. T-Mobile’s groundbreaking alliance with SpaceX’s Starlink acted as a catalyst, launching a functional D2D messaging service that instantly put the entire industry on notice. This strategic move transformed satellite connectivity from a niche concept into an essential feature for a competitive mobile network, forcing rivals like AT&T and Verizon to accelerate their own orbital strategies or risk being left behind in a new era of connectivity.

A Tale of Two Strategies: Speed vs. Power

T-Mobile’s First-Mover Advantage: Capturing the Market Early

T-Mobile’s primary advantage is its presence in the market. Having already launched its national satellite messaging service, the “Un-carrier” is not just testing a concept but actively refining a commercial product. The service has already evolved beyond simple emergency texts to support popular data applications like WhatsApp and Google Maps, embedding its utility into the daily lives of its subscribers. In a clever strategic play, T-Mobile has also opened its D2D service to AT&T and Verizon customers, a tactic designed to build brand familiarity and showcase its capabilities to a rival’s audience. This head start provides T-Mobile with invaluable real-world data, user feedback, and market momentum, creating a significant competitive gap that AT&T must now work to close.

AT&T’s High-Stakes Bet on Superior Technology

In response, AT&T’s strategy isn’t to be first, but to be better. Its partnership with AST SpaceMobile is built on a foundation of technological ambition. The core of this plan is AST’s new generation of BlueBird satellites, massive 2,400-square-foot arrays designed to deliver genuine broadband speeds for both voice and data directly to unmodified smartphones. This capability represents a significant leap beyond the text-focused services offered by some competitors. AT&T is methodically rolling out its service, starting with a “beta” test for consumers and critical FirstNet public safety users. The viability of this technology has already been proven in successful trials with first responders, validating its potential to deliver a more robust and capable connection from space.

The Complex Realities of a Crowded and Capital-Intensive Race

AT&T’s path forward is fraught with challenges. The initial service, reliant on a small number of newly launched satellites, will be “intermittent” until a more substantial constellation of 45 to 60 satellites is operational toward the end of the year. This phased capability depends entirely on AST SpaceMobile’s aggressive and flawless execution of a launch cadence of one to two satellites every month—a monumental logistical and financial undertaking. Furthermore, this is not a simple two-horse race. Verizon has also partnered with AST SpaceMobile, while Apple has its own established satellite service via Globalstar, and cable giants Comcast and Charter are entering the fray through a partnership with Skylo. This crowded field intensifies the pressure, meaning any delay in AT&T’s deployment could prove costly.

The Future Trajectory: From Niche Feature to Industry Standard

The current push for D2D connectivity signals a fundamental shift in the telecommunications landscape. What began as an emergency messaging feature is rapidly evolving toward a baseline expectation for continuous, high-quality service. As LEO constellations grow more powerful, the industry will move beyond basic connectivity to offer true broadband speeds, enabling everything from video streaming to complex enterprise and Internet of Things (IoT) applications in previously unconnected regions. The long-term success of these ventures will depend not only on technological prowess but also on developing sustainable economic models to manage the immense cost of building and maintaining these orbital networks.

Strategic Imperatives for a Connected Future

The central takeaway from this emerging battle is the strategic divergence between T-Mobile’s speed-to-market approach and AT&T’s bet on a technologically superior, albeit later, entry. For AT&T, the path to success is clear but narrow: it must ensure its partner, AST SpaceMobile, executes its ambitious launch schedule without a hitch to close the coverage gap and deliver on its promise of true broadband from space. For consumers and businesses, the intensifying competition is an unequivocal win, heralding an end to the era of coverage dead zones and ushering in a new standard for what it means to be connected.

The Verdict: A Marathon, Not a Sprint

So, can AT&T catch T-Mobile? The answer is a qualified yes, but the challenge is immense. While T-Mobile is currently leading the race, its advantage is built on a service that may soon be leapfrogged by the more powerful capabilities AT&T aims to deploy. The race for satellite supremacy is not a short sprint but a long and capital-intensive marathon. The ultimate winner will not necessarily be the first out of the gate, but the one who can deliver the most reliable, capable, and seamless service. This competition will fundamentally redefine the boundaries of mobile communication, and the final outcome will shape the connected world for years to come.