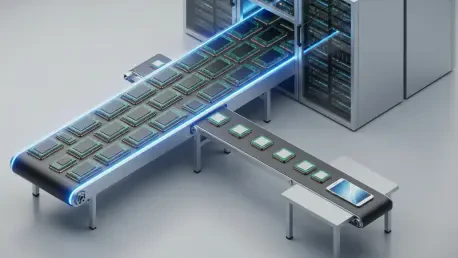

The insatiable appetite of the artificial intelligence industry for high-performance components has inadvertently triggered a severe supply chain crisis, casting a long shadow over the smartphone market and the global expansion of 5G networks. In a strategic pivot with far-reaching consequences, major memory suppliers are reallocating their production capacity away from the standard DRAM and NAND chips that power consumer devices. Instead, they are prioritizing the manufacture of high-capacity memory products essential for AI data centers, creating a scarcity that has upended the traditionally cyclical chip market. This shift has already ignited an unprecedented price surge, with some memory component costs climbing by 25%. Industry analysts from Counterpoint Research project a continuation of this steep upward trend, forecasting an additional 40% price increase through the second quarter of 2026, a development that promises to reshape the economic landscape for both device manufacturers and telecommunications operators worldwide.

A Twofold Crisis for Operators and Manufacturers

The direct fallout from this memory chip inflation is being felt most acutely on the manufacturing floors of smartphone companies, where rising component costs are squeezing already thin profit margins. This price escalation translates directly into a higher bill of material (BoM) for each device, with estimates suggesting an increase between 8% and 15% for the average smartphone. This added financial pressure is expected to have a tangible impact on the global market, with projections indicating a corresponding 2.1% drop in worldwide smartphone shipments. However, the impact of this crisis is not being distributed evenly across the industry. While market leaders like Apple and Samsung possess the scale, negotiating power, and brand loyalty to weather the storm with only a moderate decline, smaller competitors, particularly lower-end Chinese original equipment manufacturers (OEMs), are positioned to bear the brunt of the downturn. These companies often operate with less financial cushion and have less leverage with suppliers, making them far more vulnerable to supply shocks and price volatility.

For telecommunications operators, the ripple effects of the AI-driven chip shortage present a formidable dual threat to their business models and growth strategies. The first and most immediate challenge is the anticipated decline in hardware revenue, an income stream that, while variable, is critical for many. For a behemoth like AT&T, device sales constitute a modest 6% of revenue, but for other operators, such as Hong Kong’s SmarTone, hardware is a cornerstone of their finances, accounting for as much as 29% of its topline income. A slowdown in handset sales directly erodes this revenue. The second, more profound threat is the consequential deceleration of 5G adoption. The expansion of 5G networks relies heavily on consumers upgrading to compatible devices. With fewer new smartphones being sold, the massive and ongoing effort to convert the world’s remaining 4.5 billion non-5G subscribers will inevitably lose momentum. This creates a significant headwind for telcos, which have invested heavily in 5G infrastructure and are counting on widespread adoption to see a return in an already saturated connectivity market.

Charting a Course Through Market Volatility

The profound market disruption created by the AI sector’s demand for memory chips ultimately forced a period of difficult but necessary adaptation across the consumer technology landscape. This unprecedented supply-side shock moved beyond a temporary pricing issue and became a catalyst for a fundamental reassessment of long-held industry dependencies and operational strategies. Smartphone manufacturers and telecommunications operators alike had to confront the reality that the once-predictable cycles of the memory market had been irrevocably altered. In response, they initiated comprehensive reviews of their supply chains, seeking to build greater resilience and diversify their sourcing to mitigate future risks. The crisis underscored the vulnerability of a globalized system heavily reliant on a few key component producers and prompted a strategic shift toward more robust, long-term partnerships and contingency planning. This period of intense pressure compelled businesses to innovate not just their products, but the very economic models that sustained them, ensuring they were better prepared for a future where competition for core technologies extended far beyond their traditional rivals.