Listen to the Article

In its annual review of global Netflow trends, Cloudflare, a prominent US-based connectivity cloud provider, has revealed a small but notable decline in the proportion of total bandwidth coming from mobile devices. The findings, published in the 2024 Cloudflare Radar Year in Review, suggest that the dominance of mobile devices in global internet traffic might be waning despite the ever-increasing ubiquity of smartphones.

Understanding the Changing Global Dynamics

Global internet traffic increased by 17% in 2024, a slower growth rate than the previous year’s 25% jump. Raw mobile traffic increased, yet cell phones now account for a slightly reduced 41.3% share of total network data flow instead of 41.9% in 2023. Surprisingly, this drop occurs despite the high smartphone adoption rate across established and emerging markets worldwide.

The Cloudflare data fails to distinguish cellular traffic from Wi-Fi influx, making it challenging to establish the specific cause of the decline in online activity. Internet traffic expansion data implies that smartphones have become less critical for fueling growth than their initial potential. This change in trends indicates that businesses need to focus on adapting to new expansion areas in data consumption rather than relying solely on mobile.

Regional Variations, Global Perspective, and Emerging Influences

The report shows that there are big differences in mobile internet use across different regions. Mobile devices create over 77% of Netflow in Sudan, Cuba, and Syria. In Finland, where Nokia is based, cell phones account for 23% of the total, while Ireland’s is even lower, with just 15%, while Iran’s has only 6% of its bandwidth from mobile devices.

These differences underscore how local infrastructure, economic conditions, and smartphone adoption rates shape web access and usage. While handheld cellular gadgets are the primary means of Internet access in many developing nations, more traditional devices like desktops and laptops dominate in certain developed regions.

For businesses that operate globally, it’s vital to grasp the differences between regions. This knowledge will help vendors improve digital strategies and meet the unique needs of each market.

In terms of data usage per active smartphone, countries like India, Nepal, and Bhutan are expected to see a substantial boost, with traffic per smartphone rising from 32 GB per month in 2024 to 66 GB per month in 2030. This represents a 13% compound annual growth rate. Conversely, in North America and Western Europe, mobile data consumption per smartphone will remain high, but growth will be more moderate, with CAGRs of 16% and 14%, respectively.

Key Factors Shaping Forecasts for 2030

Global macroeconomic changes, such as inflation and interest rates, could impact consumer spending and the affordability of cellphone data services. The pace of subscriber migration to later generations of mobile technology, particularly in regions like India, Latin America, Southeast Asia, and Africa. Smartphone shipment development, as the demand for new devices with more advanced capabilities, can drive higher data usage.

B2B professionals should think about how changes in the economy and shifts in regions may affect how they use data. Which is what you want to focus on when creating strategies for improving networks, or engaging with customers globally. So watch out for the following key shifts:

The uptake of new consumer applications (such as Extended Reality technologies, which include augmented reality, virtual reality, and mixed reality) and the adoption of AI-enabled tools are expected to contribute to more data-intensive consumption.

The increasing shift toward Fixed Wireless Access connections in regions with limited fixed broadband infrastructure could impact data consumption patterns and alter how traffic is distributed between mobile and fixed wireless access networks.

These factors could significantly change the forecasts depending on how quickly these trends evolve globally.

Slowing Growth and New Drivers in a Saturated Market

The decrease in mobile data as a percentage of overall network traffic has made industry analysts wonder if data expansion has reached its maximum potential. The worldwide growth rate continues to expand slowly, with Ericsson predicting that year-on-year figures will drop from 21% in 2024 to 16% by 2030.

For B2B professionals, this signals that the mobile-first approach may need to be revisited in favor of other upgrades, such as 5G or fixed wireless connections. The drop in mobile traffic shows that focusing on new technologies may be a better investment in the future, as it may have happened for a few reasons.

Many regions have reached smartphone market saturation, and more people have access to fixed broadband. As fixed wireless connections grow, especially in areas where traditional broadband is slow, mobile data traffic will continue to increase, but the growth rate may not be as fast as in the early days of wireless internet.

Moreover, the migration to 5G will likely continue to drive significant increases in mobile data usage. Still, the overall cellular data traffic growth will likely decrease as markets mature and reach saturation points. As seen in more developed regions, where 4G adoption is already widespread, future growth in cellular data usage may become more closely tied to innovative applications (such as extended reality and AI-enabled tools) rather than the sheer increase in the number of devices connected to the network.

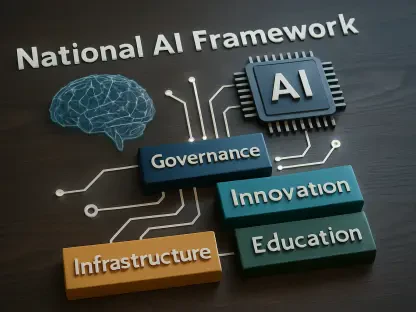

AI and 5G: Drivers of Future Data Expansion

As AI technologies expand, there are growing expectations that they will significantly boost this phenomenon. Some estimates suggest that mobile data traffic could increase three to five times as artificial intelligence applications, including generative AI, become more integrated into cell phones.

According to forecasts, global cellular data usage is set to grow by a factor of 2.5, reaching 303 exabytes per month by 2030, with fixed wireless access bringing this figure to an estimated 473 exabytes per month. This surge is expected to be driven by the widespread deployment of 5G networks, which are projected to carry 80% of smartphone browsing by 2030.

Despite this, the full impact of AI remains uncertain. While AI investments drive growth in hyperscale data centers, some network operators have seen slower-than-expected growth in data traffic.

For instance, broadband data consumption in the US grew by only 7.2% in 2024, the lowest increase since 2012. This suggests that AI could eventually lead to significant increases in mobile data traffic, but the immediate effects may be more gradual than anticipated. Nevertheless, with the potential for AI to drive demand for telecom infrastructure, investments in fiber, small cells, and wireless networks are expected to increase significantly in the coming years.

The Unseen Stability of Global Data Streams

While cellular data usage growth has declined, Cloudflare’s report states that the internet services landscape is still stable. Google is the most popular search engine as it leads in web browsing. Facebook is the most used social media platform. WhatsApp is the favorite messaging app.

Notably, Starlink’s traffic growth is also stable, expanding at roughly three times the rate of general internet traffic. Regarding quality, Spain has been identified as the leading country for a combination of metrics, including average download speeds and overall network reliability. With consistent service providers and technologies, changes in mobile traffic share will not harm your browsing or downloading experience. For B2B businesses, this stability shows that using a mix of internet connections—like mobile, fixed broadband, and satellite—is important for future growth.

What’s Next for Mobile Internet Traffic?

While more people are using handheld devices, the growth rate is slowing down. This suggests that mobile devices may no longer be the main reason for increased internet traffic. Smartphone vendors, service providers, and infrastructure companies could now be in for a ride, all having made big bets dependent on wireless network service that continues to hold hegemony.

As mobile usage stabilizes in some areas and fixed broadband internet access continues to grow, people’s browsing habits may become a better mix of wireless and traditional connections. The coming years will likely offer more insights into whether this decline in mobile’s share of total traffic is a short-term anomaly or the beginning of a broader trend.

In this regard, overall mobile data traffic is projected to grow because of the rise of 5G technologies and fixed wireless access, among other reasons. However, the share of cellular data traffic may decrease, suggesting that the online ecosystem is maturing. With this, new forms of data access/usage will dominate the future of the World Wide Web.